Tempestuous March markets tend to drive prices up early in the month and batter stocks at month end, asserts Jeffrey Hirsch, seasonal timing expert, editor of Stock Trader's Almanac — and a participant in MoneyShow's Accredited Virtual Expo on March 2-4. Register for free here.

Julius Caesar failed to heed the famous warning to “beware the Ides of March” but investors have been served well when they have. Stock prices have a propensity to decline, sometimes rather precipitously, during the latter days of the month. In March 2020, DJIA plunged 4011 points (-17.2%) during the week ending on the 20th.

March packs a rather busy docket. It is the end of the first quarter, which brings with it Triple Witching and an abundance of portfolio maneuvers from The Street.

March Triple-Witching Weeks have been quite bullish in recent years. But the week after is the exact opposite, DJIA down 22 of the last 33 years—and frequently down sharply. In 2018, DJIA lost 1413 points (–5.67%)

Notable gains during the week after for DJIA of 4.88% in 2000, 3.06% in 2007, 6.84% in 2009, 3.05% in 2011 and 12.8% in 2020 are the rare exceptions to this historically poor performing timeframe.

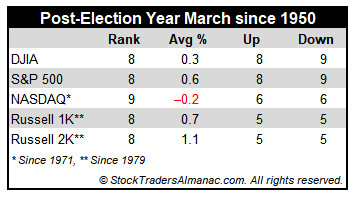

Normally a decent performing market month, post-election year payments to the Piper take a toll on March as average gains are trimmed noticeably.

In post-election years March ranks: 5th worst for DJIA, S&P 500, Russell 1000 and Russell 2000; NASDAQ is 4th worst. In 12 post-election years since 1973, NASDAQ has advanced six times, with three in a row 2009, 2013 and 2017.