Articles on Futures, Commodities, & Options

Experts on Futures, Commodities, & Options

Virtual Learning

Conferences

Cruises

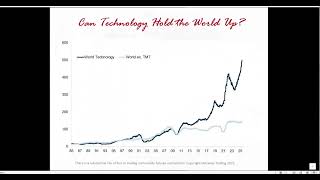

The growth of financial futures has been one of the most remarkable success stories in the markets. Their age is relatively green at just a little over 50 years old. Originally created to help farmers hedge against price changes between crop planting and harvesting, futures have grown since then to include interest rates, foreign exchange, metals, energy, weather, and even Bitcoin.

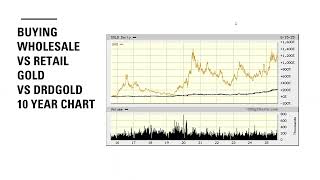

Whether trading agricultural commodities, energy futures, metals, stock indexes, or even the softs; futures provide the best bang for your buck. But leverage is a two-sided blade. In this section, MoneyShow.com trading experts provide a deep dive into the current futures market activity and price action to help you find ways to strengthen your portfolio, while mitigating risk and exploiting opportunities in these diverse markets.

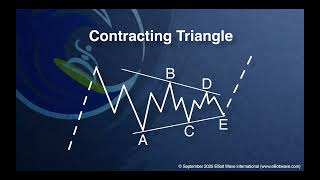

Discover unique and critical futures trading strategies to help you generate more consistent profits and better manage your portfolio risk. From in-depth futures market economics to spread trading, you will take away new knowledge to help you better identify trading opportunities. Our contributors will share with you their time-tested commodities investing strategies and futures trading strategies. The insights you will learn will help you in your investing or trading with market intelligence that you cannot find elsewhere.

At the same time, the opportunities now available to individual traders in the option arena are astounding, having exploded in volume and complexity in recent years, offering option traders the ability to trade, hedge, or speculate in just about any stock, ETF, or commodity.

Our goal in these pages is to start you down the path of options trading and help you avoid many of the pitfalls that beginning options traders experience. Some of the top names in trading will familiarize you with options—what they are, how they work, and what opportunities they present. You’ll learn practical knowledge about when it is appropriate to buy/sell puts or calls, covered-call writing strategies, and advice on when to use each of these strategies. More experienced traders will learn profitable options trading strategies to help you make more money and better manage your portfolio risk.