Follow

About John

John Buckingham joined AFAM Capital in 1987 and Kovitz in 2018, as part of the Kovitz acquisition of AFAM. He has more than 30 years of investment management experience and serves as editor of The Prudent Speculator, which has been a trusted newsletter for over 40 years. Mr. Buckingham chairs the AFAM Investment Committee, leading a team that performs comprehensive investment research and financial market analysis. He has been featured in Barron's, The Wall Street Journal, and Forbes, and frequently contributes to CNBC, Bloomberg, and Fox Business News. Mr. Buckingham is a recognized industry contributor who regularly speaks at prominent industry seminars and events.

John's Articles

Air Products & Chemicals Inc. (APD) fell more than 6% last week after announcing advanced talks with Yara International, a Norway-based fertilizer producer and global ammonia distributor, on two major projects in the US and Saudi Arabia. But our target price now stands at $360, observes John Buckingham, editor of The Prudent Speculator.

This is a market of stocks, not simply a stock market. So, while pundits fret about a broad-based index like the S&P 500 (^SPX) trading at a nosebleed forward P/E of 25.7, those willing to venture into individual equities have plenty of inexpensive names from which to choose. I like International Paper Co. (IP), writes John Buckingham, editor of The Prudent Speculator.

NetApp Inc. (NTAP) reported a good fiscal Q1, but shares plunged in after-hours trading on Wednesday, before recouping all those losses and then some by soaring on Thursday, only to sink anew on Friday. For the full week, shares advanced more than 2%, even as the storage and data management concern offered only a modestly positive outlook, highlights John Buckingham, editor of The Prudent Speculator.

Once again, investors have been reminded that far more money has been lost in trying to anticipate corrections than has been lost in the corrections themselves. Meanwhile, TotalEnergies SE (TTE) is a French-based, integrated energy company with operations spanning oil, gas, LNG, refining, and renewables that I like here, writes John Buckingham, editor of The Prudent Speculator.

John's Videos

Learn from the editor of the top-ranked newsletter, The Prudent Speculator, about why inexpensively priced dividend-paying stocks can help investors always remember the famous quotation, “If you do not change direction, you may end up where you are heading.” Plus, receive his current undervalued yield-focused stock picks.

John Buckingham, Editor of the Prudent Speculator newsletter, points out a simple truth: Even economists can't predict the economy! So in this interview, he explains why investors shouldn't even try -

While media market gurus are recommending traders protect their portfolio now that the market is experiencing higher volatility.

John Buckingham explains why the recent equity market volatility is normal and healthy for the markets.

Newsletter Contributions

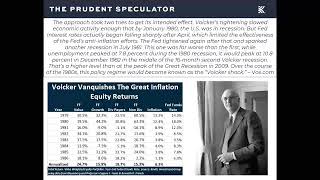

The Prudent Speculator

Your time and money are valuable. After 33 years writing The Prudent Speculator and managing our proprietary investment strategies for AFAM Capital and now Kovitz, John Buckingham guarantees that you will believe this is worth every minute you spend reading the newsletter.

Learn More