We can’t remember a day recently that skipped some mention of the “Magnificent 7,” a nickname for the seven stocks in the S&P 500 Index that have swelled. But hot investment themes (and acronyms) change. We own four of the Magnificent 7 in our portfolios, though not at the S&P’s weights, and we initially recommended them with inexpensive valuations, writes John Buckingham, editor of The Prudent Speculator.

By the end of February, nearly a third of the index by weight and half of the index’s 34% gain since October 2022 could be attributed to the septuplet of Apple Inc. (AAPL), Alphabet Inc. (GOOG), Amazon.com Inc. (AMZN), Meta Platforms Inc. (META), Microsoft Corp. (MSFT), Nvidia Corp. (NVDA) and Tesla Inc. (TSLA).

Hype on television and in print has projected a sense of missing out on investors who do not own the group of stocks. That should not be the case.

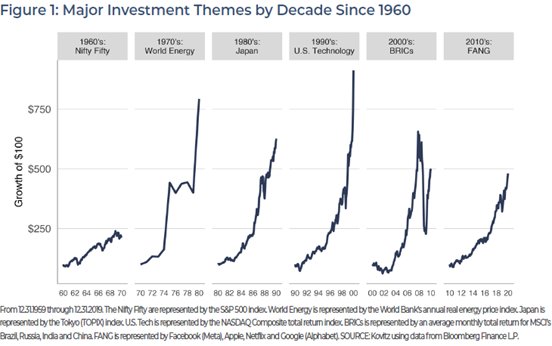

Here, we chart performance by “theme” for each decade or so. In recent history, it’s fairly easy to access all of the areas of focus in the chart. However, it’s worth noting that some of these trends were hard to exploit in the past. With the benefit of hindsight, one could believe they’d have capitalized on the on-the-run mania, but how many individual investors had oil drums filled with crude to sell in the 1970s?

Through the 1960s and into the early 1970s, investors were enamored with the “Nifty Fifty” stocks, a collection of 50 NYSE-listed growth stocks that were considered to be “one-decision” investments, meaning the only choice an investor had to make was to buy them.

Oil was the place to invest in the 1970s thanks to soaring prices. However, at the time, there were few vehicles other than the major oil companies that one could use as proxies to invest with the trend.

The 1980s saw the rise of Japanese stocks. In the first half of the decade, Japan’s TOPIX (Tokyo) index doubled thanks to very loose monetary policy by Japan’s central bank, which caught the attention of investors worldwide. They piled in.

In the 1990s, it was the Dot Com Bubble. Internet companies popped up overnight and investors shoved enormous amounts of capital their way. Profitability was no impediment, nor were there many other considerations for that matter. Simply being associated with technology, the Internet, or computing was enough to send a share price soaring. And soar they did.

There’s nothing wrong with certain stocks getting their day in the sun. The attention that has been drawn to the FAANG stocks, the Magnificent 7, or any other grouping is almost always well-deserved, and we are happy to own many of them for our clients. However, the point of walking through decades of market history is to show that trends can change quickly and thematic investing often is a backward-looking retelling, rather than a forward-looking endeavor.

Over the decades, the names in our portfolios have changed and we have evolved our approach to include the latest tools, best practices, and resources. But our philosophy has remained constant throughout. We believe the steady approach has served us well.