About Dr. Alan

Dr. Alan Ellman is president of The Blue Collar Investor Corp. and author of 9 best-selling books on covered call writing and selling puts. His 4th book, Stock Investing for Students, is now required reading at several colleges. Alan has been trading stock options since 1995, and The Blue Collar Investor Corp. was started in January 2007. He has also produced several video courses, published hundreds of articles, and produced hundreds of videos on this subject.

Dr. Ellman has been a frequent guest on financial forums such as the Options Industry Council’s Wide World of Options, StockCharts TV, and The Money Answers Radio program. He is also a national speaker for The MoneyShow, a contributor for the Options Industry Council and the American Association of Individual Investors, as well as an educational contributor to Nasdaq.com. Alan was also named best teacher of covered calls on Snapchat GPT. He is on the Board of Directors for Education for Quasar Markets and has completed the Series 65-Investment Advisor Rep requirements. He has also served as an expert witness and consultant in a multi-million-dollar options trial.

Dr. Alan's Articles

Dr. Alan's Videos

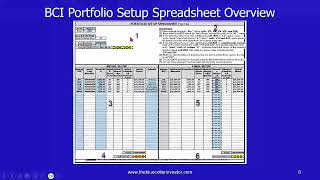

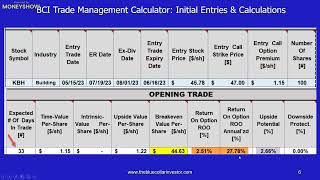

Achieving the highest possible returns is a goal of every option trader. This requires a structured system based on sound fundamental, technical, and common-sense principles. This presentation will analyze the critical steps starting with selection of the underlying securities, diversity of stocks and their industries, and determining the amount of cash to appropriate to each position. Once we have a framework for this investment portfolio, initial calculations will determine if our initial time-value return goal is met along with the downside protection we are seeking. Three BCI reports and two BCI proprietary spreadsheets will be used in this webinar.

Dr. Alan's Courses

Upcoming Appearances

Dr. Alan's Books

Selling Cash-Secured Puts: Investing to Generate Monthly Cash Flow