Articles on Investing Strategies & Personal Finance

Experts on Investing Strategies & Personal Finance

Virtual Expos

Virtual Learning

Conferences

Cruises

Generating consistent gains in an ever-changing market is nearly impossible unless you know how (and when) to adapt to different market phases. Even a great strategy won’t work in the wrong conditions, and managing the money that you already have in the markets effectively is just as important as making the initial investment or placing the trade. In this section, you can learn about specific investing strategies and investment picks that will allow you to dampen risk without giving up solid gains. You’ll learn how to generate superior returns to establish a margin of safety in anticipation of black swan events and market anomalies.

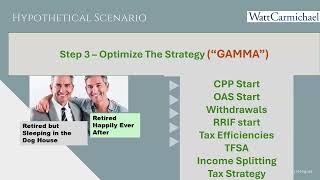

With headwinds such as a longer time horizon, the current low-yield market environment, and the need to strategically allocate beyond stocks, bonds, and funds, there are several distinct and important financial decisions that really matter. Those are the ones you need to get right, so you don’t run out of money during your golden years. But, even the best-laid retirement plans can harbor hidden risks, including longevity risk, sequence-of-return risk, and underspending. The nature of risk changes in retirement, as the lifestyles of retirees become more vulnerable to the impacts of market volatility, unknown longevity, and spending shocks. Learn how to safeguard your portfolio and your plan against these risk factors.

With volatility making a comeback in the markets, investors are looking for the best investment strategies to protect—and grow their portfolios—in a challenging environment. Uncover effective strategies for managing your assets for a longer period of time, given current market conditions and longer life-span expectations. Learn about specific investments that could accomplish the goal of making your nest egg comfortably provide an income throughout your lifetime.