There are many different companies that can give investors exposure to the water business; here, we continue a review of the 5 best water stocks by Nikolaos Sismanis, contributing editor at Sure Dividend.

Yielding 1.6%, American States Water (AWR) is a utility company with two business units: Utilities (primarily water, some electricity) and Services (wastewater services on several US military bases).

American States Water is based in California, where it operates its utility business. The company’s services unit spans several US states. American States Water is also a Dividend King, having raised its dividend for 66 consecutive years.

Read Part 1 of this special report here.

Read Part 2 of this special report here.

Read Part 3 of this special report here.

The company reported its first-quarter earnings results on May 3rd, 2021. Fully diluted earnings-per-share increased from $0.38 in Q1 2020 to $0.52 in Q1 2021, while revenue for the first quarter grew by 7.3% to $117.06 million year-over-year. Consolidated adjusted diluted earnings per share increased by 20.9% per share, compared to last year’s quarter.

Between 2011 and 2020, American States Water grew its earnings-per-share at a rate of 7.6% annually. The company managed to increase its profitability even during the last financial crisis, which shows that American States Water’s profitability is not cyclical.

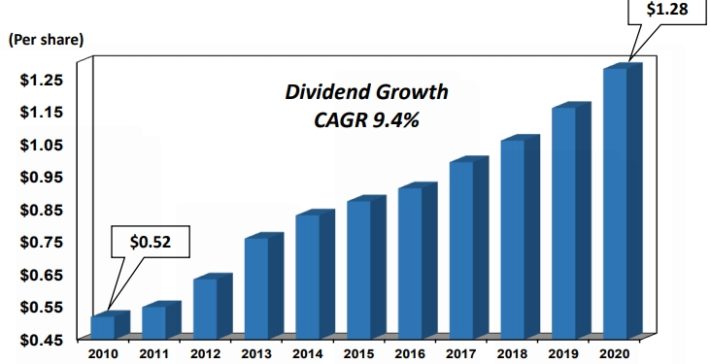

We expect the company to retain its robust performance regardless of the state of the economy. Therefore, it should be able to maintain and extend its prolonged dividend growth, which features a 10-year CAGR of around 9.4%.

Source: Q1 Presentation

American States Water’s utility revenues will most likely continue to grow at a slow pace, as regulators will allow the company to increase its rates over time in order to encourage spending on growth and maintenance projects. The company is building out its services business by getting contracts for wastewater services on additional US military bases.

The contracts for wastewater services on US military bases span a 50-year period each, so getting one such contract provides for a decades-long and very safe revenue stream.

The company has increased its dividend every year for 66 years in a row, which can only be described as a very long and successful dividend growth track record.