Jazz Pharmaceuticals Plc (JAZZ) is an Ireland-domiciled biopharmaceutical firm focused primarily on treatments for sleeping disorders and oncology, explains Jim Woods, growth stock specialist and editor of Bullseye Stock Trader.

Jazz has nine approved drugs across neuroscience and oncology indications; its portfolio includes Xyrem and Xywav for narcolepsy, Zepzelca for the treatment of metastatic small cell lung cancer, Rylaze for acute lymphoblastic leukemia and Vyxeos for acute myeloid leukemia.

In May 2021, Jazz acquired GW Pharmaceuticals and gained its leading product, Epidiolex for the treatment of epilepsy. This product is in the very promising CBD space (medical cannabis), and it is a cannabidiol-based therapy that treats seizures associated with the most severe forms of epilepsy such as Lennox-Gastaut syndrome and Dravet syndrome.

Jazz is a company that is hitting the “bullseye” on numerous fronts that I look for in a winning trade. First, it grew earnings per share (EPS) 23% last quarter, a move that has helped put it in the top 14% of all companies on an EPS growth basis.

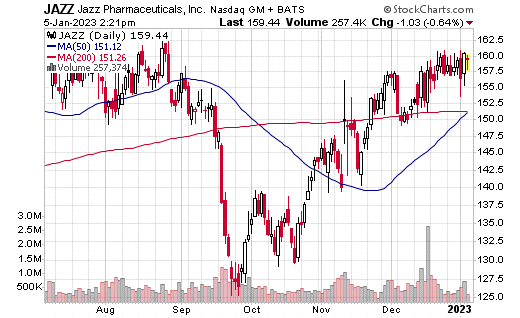

As for relative price strength, the 52-week gain of 23% is superb, and that puts the stock in the top 12% on a relative strength basis. Plus, shares are up some 15% in just the past three months, so momentum is there.

Technically speaking, JAZZ shares now are forming the “handle” in a bullish “cup-with-handle” pattern (although it is not a perfect cup-with-handle, but nothing in life is perfect).

JAZZ has two positive NewsQ catalysts in front of it that I think will be huge drivers of the share price. First is the company’s next earnings release on Feb. 28. If the company can beat the somewhat modest expectations, I think the stock can surge.

Then, there is the Epidiolex, which is in a Phase 3 clinical trial. If that gets approval, then the spike is on. Plus, JAZZ also reportedly has over a dozen other CBD and non-CBD programs, so it is not resting on its pharmaceutical laurels. Given “all that jazz,” let’s buy Jazz Pharmaceuticals at market, with a protective stop set at $140.00.