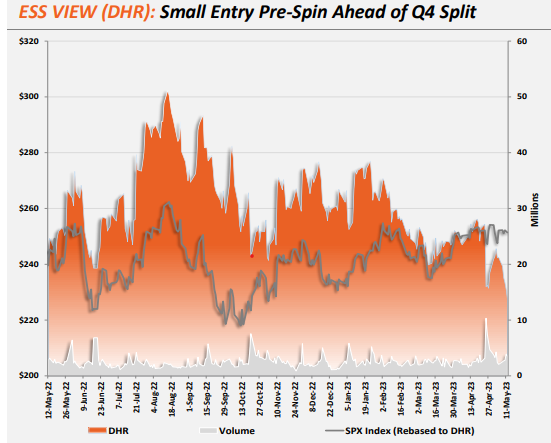

Danaher Corp. (DHR) is an industrial and healthcare firm that is creating value by spinning off select divisions. Accumulate its shares ahead of the pending Veralto (VLTO) deal, advises Jim Osman, editor of The Spinoff Report Lite.

Veralto is DHR’s Environmental & Applied Solutions unit and post-spinoff, it will be the global leader in Water Quality (59% of 2022 revenue) and Product Identification (41% of 2022 revenue). We believe VLTO will be well-positioned to leverage its leadership in high-growth areas in a highly unorganized market with strong earnings visibility due to ~55% of recurring revenue and attractive margins.

Owing to its leadership position, VLTO management might explore separating its Product Identification segment in the future. We believe management is following a similar pattern for value creation, i.e., the DHR/Fortive Corp. (FTV) spinoff similar to this DHR and VLTO spinoff.

DHR was co-founded by the billionaire Rales brothers (Steven and Mitchell), where most of their wealth is linked to DHR. In the last ten years, DHR has generated a total return (CAGR) of 18.77% vs S&P’s total return of 11.86%. DHR is shifting its focus towards becoming a pure-play healthcare player.

Looking at its organic and inorganic growth, the Rales brothers’ value creation philosophy (Steven and Mitchell), and other technical factors, we believe DHR is a good long-term stock to accumulate ahead of the Spinoff.

Spinoff Date: Q4 2023

Next Earnings Event: Jul 20, 2023 (est.)

Upside Potential (Pre-Spin): +16% (Base Case) & +24% (Bull Case)

Recommended Action: Buy DHR.