I went into the bank a few days ago and was talking to the teller about putting my nephews as named beneficiaries on my accounts. That led to a discussion about high-yield savings accounts. But I think they pale in comparison to dividend stocks like Enterprise Products Partners (EPD), says Kelly Green, editor of Dividend Digest.

Think about it: According to Bankrate.com, I can get a high-yield savings account with interest of around 4.5%. Meanwhile, the average current yield of my Yield Shark open portfolio is 6.6%.

What about the uncertainty?

I’m not saying just go out and start grabbing dividend stocks because they have yields over 4.5%. Dividends are up to the discretion of the management of a company. At any point, a company could see its dividend slashed or cut completely.

We do occasionally utilize preferred stocks and exchange-traded bonds to offset this risk, but even then, the risk is never 0%.

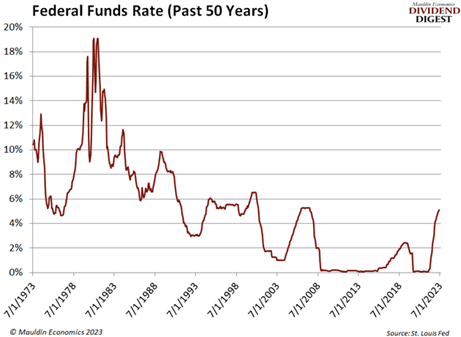

That said, I don’t believe that the 4.5% on a high-yield savings account is any safer in the long term. Rates on savings accounts are variable. These rates are loosely linked to the Fed funds rate, but they’re mostly impacted by competitive pressures from other institutions.

Yes, we’ve seen the Fed funds rate increase over the past few years. But we can’t forget the 10 years it was essentially 0%.

I’ve got some guesses where the peak will be this go-round, but I don’t want to stake my yield on guesswork and the whims of government officials. Instead, I’m going to stick with the power of dividends for both my short- and long-term investments.

When I get any money, I divide it into three baskets:

- Bills

- Spending

- Investment

That investment money is further divided into income generation and wealth building. These correspond with the Yield Shark portfolio designations of Current Yield and Bedrock Income.

For my income-generation money, 4.5% is simply not enough yield.

For my wealth-building money, being at the mercy of the Fed funds rate is not ideal. (I may be biased due to the zero-interest-rate environment I’ve experienced throughout most of my adult life.)

Instead, I look for companies with proven track records of increasing their dividends and solid businesses to continue doing so for many years to come.

I’ve given Dividend Digest readers some of my favorite ways to profit from dividends. EPD is still one of my favorite Bedrock holdings. And its 7.3% current yield makes it a great alternative to a high-yield savings account for both short-term and long-term investors.

Recommended Action: Buy EPD.