The weakness in gold over the past couple of sessions is due to relief on the tariff front, as the Trump Administration has sealed some deals with trade partners. But if you think this ends the macroeconomic risks – as deficits continue to soar and inflationary pressures continue to bubble – just watch what happens in the weeks ahead, says Brien Lundin, executive editor of Gold Newsletter.

Nothing is easy when it comes to timing the markets, especially if that market is gold. It seems like the metal takes pleasure in making prognosticators look foolish. This is why, after decades in this business, I take care to hedge my views.

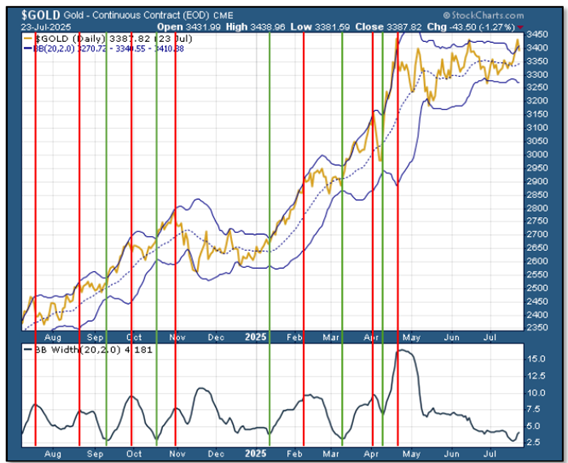

I recently noted the following in regard to our chart of gold’s tightening Bollinger Bands: “The lower panel tracks the width of the bands and, therefore, the trading volatility. As you can see, the width has collapsed to levels that have previously marked bottoms and imminent rallies. In fact, the width trendline is continuing to fall, possibly indicating a continued sideways pattern, or even more coiling before the next rally.”

While I didn’t predict the rally would come right away, two days of powerful gains followed that commentary, which were in turn followed by two days of selloffs. Ironically, the result of all this back-and-forth over the past week is that the width of gold’s Bollinger bands is increasing.

Add it all up, and it looks like our summertime slowdown will be extended a little longer. In the meantime, the performance of the gold stock sector during this slump has been encouraging. The equities have been consistently outperforming the metal.

We’ve also seen, at least anecdotally, that this performance has drifted down the food chain into the juniors. We’ve seen a surge of financings for these companies lately, and the flow of news has morphed into a veritable flood.