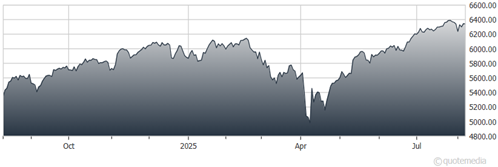

The US equity markets just had a strong week on the heels of better-than-expected earnings growth this quarter and some weaker-than-expected demand for Treasuries. Meanwhile, though recent tariff developments would have moved the markets back in April, they’re not even putting a dent in sentiment today, observes Michael Gayed, editor of The Lead-Lag Report.

Adding support is the expectation for interest rate cuts starting next month, with the market starting to increasingly price in the possibility that we’ll get one at each of the meetings remaining this year. Without any major narrative changes, investors feel comfortable in risk-seeking although there are a few risks lurking in the background.

S&P 500 Index (^SPX)

The White House’s proposed 100% tariff on chip imports would certainly reset the global semiconductor industry, but it seems unlikely that there will be any long-term follow-through on this. The same thing goes for tariffs that went into effect last week. Negotiations will likely be ongoing – and Trump’s history of delaying tariffs could very well happen again here.

After hitting the low 20s last week, the VIX is back in the mid-teens, which suggests that investors don’t seem that concerned. With the Q2 earnings season mostly in the rearview mirror, it’s looking like the market may remain relatively calm through the end of the month. Geopolitics, outside of the trade war, seem mostly contained at the moment.

That said, the market is getting some potentially concerning data on the labor market and inflation. But nothing yet is suggesting that anything is going bust. Investors seem to want to be risk-on right now, but things could start changing as we approach the Fed’s September meeting.