Stocks are easing back after a late-day rally yesterday. But gold is surging, taking silver along for the ride. Crude oil, Treasuries, and the dollar are mostly flat.

The Federal Reserve just started Day 1 of its latest two-day policy meeting. But markets are largely ignoring the gathering because the Fed has made clear it will neither hike the federal funds rate again – nor cut it – this time.

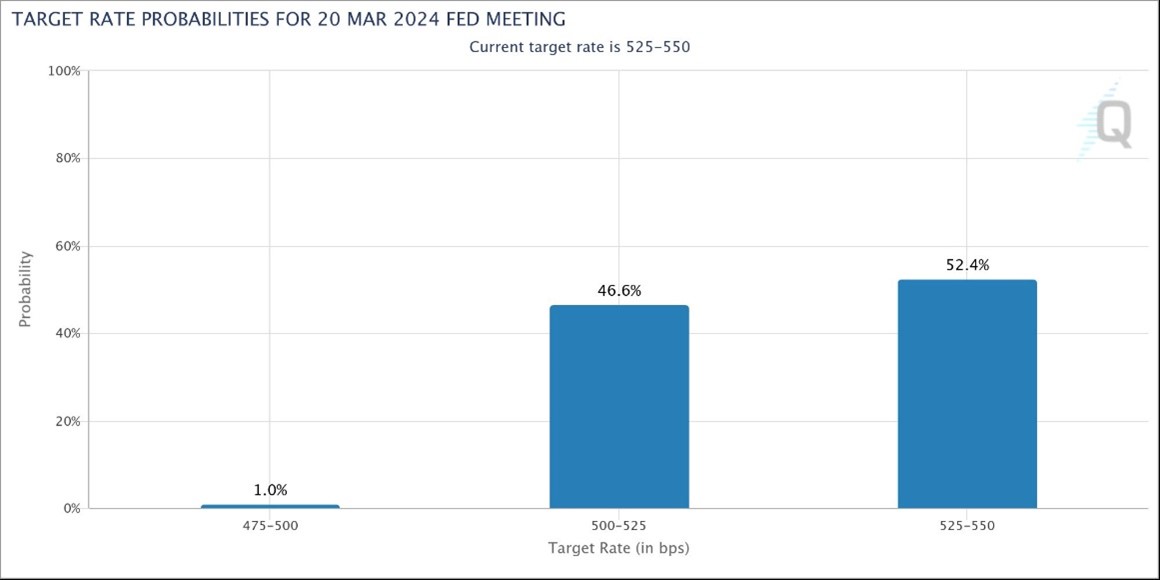

The real fireworks, if any, will come in the post-meeting press conference when Jay Powell provides fresh guidance on what to expect next. The rate futures markets are close to evenly split on whether the Fed will lower rates by 25 basis points at the meeting that concludes March 20, as you can see in this chart. The current funds rate target is 5.25% - 5.50%.

March Fed Meeting Projected Rate Outcome

Source: CME FedWatch Tool

In the Middle East, the US has not yet responded with open military force to the attack that killed three service members at a remote Jordanian outpost. But deliberations are underway between President Biden and key military advisors – and any counterstrikes could be more aggressive and sustained than what we’ve seen so far. Of the two markets most sensitive to geopolitical concerns, gold has risen about a half-percentage point in the past five days while oil has gained 2.5%.

Finally, a bevy of “Big Tech” names will be updating investors on earnings and sales trends starting after today’s closing bell. Microsoft (MSFT) and Alphabet (GOOGL) are on tap this afternoon, with Apple (AAPL), Amazon (AMZN), and Meta Platforms (META) to follow Thursday. Buckle up!