Stocks are trading around the flatline in the early going. Crude oil and the dollar are a bit higher, while gold, silver, and Treasuries are modestly lower.

The S&P 500 came within a whisker of hitting 5,000 for the first time ever yesterday, touching 4,999.89 on an intraday basis before pulling back. Will today be the day we get SPX 5K? We’ll see. But a key semiconductor name, Arm Holdings (ARM), is skyrocketing on strong earnings, while media and theme park giant The Walt Disney Co. (DIS) is also rallying after torching profit estimates, boosting its dividend, and approving a $3 billion stock buyback.

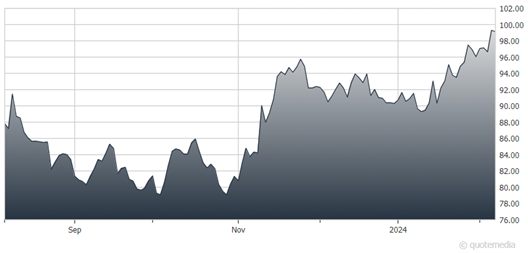

The Walt Disney Co. (DIS)

When a wave of spot Bitcoin ETFs hit the markets last month, we initially saw a “Sell the news” reaction. But now, the cryptocurrency is steadily climbing again – nearing $45,000 earlier today for the first time since Jan. 12. Many investors are looking forward to this-year’s “halving” event as a potential catalyst for more gains. That reduces the number of Bitcoin that a miner receives for solving the transaction puzzles built into the cryptocurrency’s ecosystem.

Finally, it’s the run up to the Super Bowl on Sunday, which means all kinds of companies are trying to capitalize on the media frenzy and focus of most of America on the “Big Game.” Domino’s Pizza (DPZ) just rolled out a deal it’s calling the Perfect Combo, which comes with two pizzas, soda, and bread sticks and bread bites.

The cost? $19.89 – a shout out to Taylor Swift’s album “1989”. As you’ve probably heard a few hundred times, she is dating Kansas City Chiefs tight end Travis Kelce and is expected to fly from her latest concert tour stop in Japan to see the game.