Equities are hovering around the flatline here, as are Treasuries, crude oil, and the dollar. Gold and silver are up slightly.

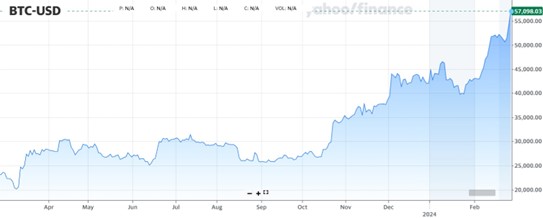

While the markets overall have been fairly quiet lately, Bitcoin has anything but. The benchmark cryptocurrency just topped $57,000, extending a two-day rally to 10%. It hasn’t been this expensive since late 2021.

Analysts believe at least some of the gains are tied to the “halving” set for April. That event is designed to reduce the release of new Bitcoin by reducing the reward for producing them by 50%. The rollout of spot Bitcoin ETFs earlier this year has also helped bring more “mainstream” money into crypto.

Bitcoin (BTC-USD)

Source: Yahoo Finance

The good news at retailer Macy’s (M)? Fourth-quarter profit beat estimates and rose from a year ago. The bad news? Forecasts for full-year earnings and revenue missed targets, and the company said it would close a third of its Macy’s-branded locations, or about 150 overall. It will add Bloomingdale’s and Bluemercury stores instead to focus on more-upscale retail operations. Meanwhile, buyout firms are circling in the background – though Macy’s has so far rejected their overtures.

Finally, “surge pricing” is coming for your burgers and fries! Fast food purveyor Wendy’s Co. (WEN) is upgrading to digital menus at many locations, and as part of that move, planning to charge higher prices when its products are in higher demand. Expect a hamburger to cost more during the lunch rush than it might in the middle of the afternoon, just like an Uber Technologies (UBER) ride costs more at rush hour or when it’s downpouring outside.