Crude oil is taking a breather after a couple big days of gains. Gold is also easing back after hitting a fresh record Friday, while equities are rallying. Treasuries and the dollar are down a bit.

Markets are cautiously optimistic here on Monday morning – but traders remain wary of developments out of the Middle East. Strikes and counterstrikes continued in Israel and Iran over the weekend, with Israeli forces reportedly gaining air superiority and operational flexibility in Iran. Still, Iran has still been able to launch almost 400 missiles and hundreds of drones at Israel, attacks that have killed and wounded dozens.

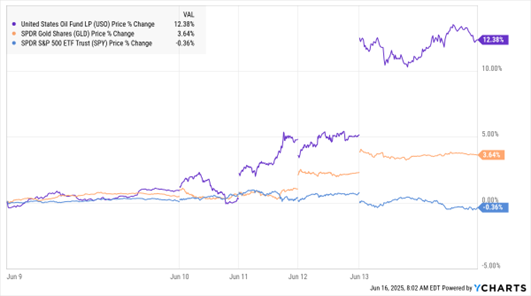

USO, GLD, SPY (5-Day % Change)

Data by YCharts

While there have been limited attacks on energy facilities in both countries, we haven’t (yet) seen the widespread destruction of oil-exporting or storage facilities. Iran also hasn’t fully committed to trying to shut down the Strait of Hormuz. That has allowed oil prices to stabilize after big increases late last week and Sunday night.

The Federal Reserve will meet tomorrow and Wednesday to discuss interest rate policy. While policymakers won’t cut rates, they will release new “dot plot” forecasts suggesting how many cuts they are leaning toward later in 2025 and early 2026. Markets are currently pricing in three 25 basis point reductions over the next year, most likely starting in September.

Finally, Meta Platforms Inc. (META) is REALLY going all-in on AI. Days after revealing plans to assemble a “superintelligence” group of Artificial Intelligence researchers, the parent company of Facebook and Instagram shelled out $14.3 billion to buy a 49% stake in Scale AI. Meta uses AI in ad targeting, creation, and engagement, among other tasks.