Markets around the world are on pins and needles, making only muted moves as traders wait to see if the US joins the fight against Iran. The calm follows a late selloff in stocks yesterday after rumors of potential US involvement spread.

As for the latest developments, President Trump met with his national security team yesterday and urged Iran’s president to agree to “unconditional surrender.” He also spoke to Israeli Prime Minister Benjamin Netanyahu.

Then this morning, Iran’s Supreme Leader Ayatollah Ali Khamenei appeared to reject the surrender request, adding that US participation in attacks on Iran would cause “irreparable damage.” He did so even as more US ships, planes, and other assets are being sent to the region. Those moves would give the US more military options if Trump decides to launch attacks.

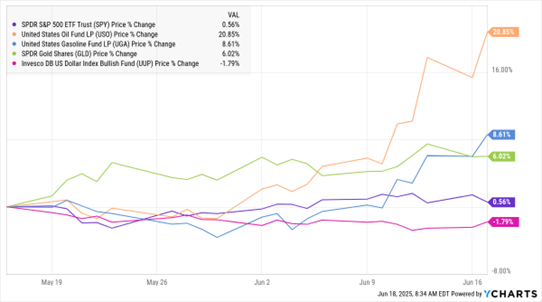

SPY, USO, UGA, GLD, UUP (1-Month % Change)

Data by YCharts

This chart shows how ETFs that track several major markets have traded in the past month – or in other words, both before and after the conflict began. The SPDR S&P 500 ETF (SPY) is roughly unchanged. But the United States Oil Fund (USO) has surged almost 21%, while the United States Gasoline Fund (UGA) has risen almost 9%. The SPDR Gold Shares (GLD) has gained 6%, while the Invesco US Dollar Index Bullish Fund (UUP) has lost 1.7%.

Meanwhile, the Federal Reserve’s latest policy meeting will conclude later today – and new “Dot Plot” forecasts from Fed members will be released. They’ll show what policymakers think will happen with inflation, unemployment, interest rates, and other indicators over the next several quarters.

Fed Chair Jay Powell & Co. won’t cut rates today. But markets will be watching those forecasts – and listening to what Powell says in today’s post-meeting press conference – closely. Investors are also wondering when Trump will announce a successor to Powell, whose term ends in just under a year. The president has made no secret of his disdain for Powell and the Fed’s reluctance to cut rates so far in 2025.