Stocks are rallying – again – after both the S&P 500 Index (^SPX) and Nasdaq Composite tested fresh all-time highs yesterday. Gold and silver are giving back some ground, while crude oil is modestly higher. Treasuries are lower, while the dollar is flattish.

Trade-related headlines have been coming fast and furious in the last 24 hours. US Commerce Secretary Howard Lutnick said yesterday that a US-China deal solidifying terms previously agreed upon had been signed. China then confirmed that news this morning.

More talks on big-picture issues will be needed. But this first step should result in rare earth materials flowing to the US from China and things like ethane flowing to China from the US. White House officials separately characterized the upcoming July 9 “deadline” for additional trade deal negotiations as “not critical” – implying it’s flexible rather than set in stone.

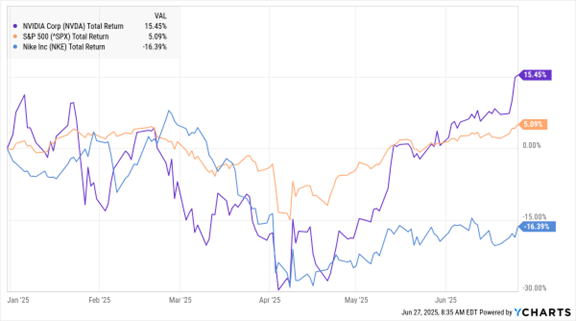

^SPX, NVDA, NKE (YTD % Change)

Data by YCharts

Meanwhile, the Trump Administration and Republicans in Congress are no longer pushing for a “revenge tax” of up to 20% on foreign companies. A provision in the large tax and spending bill being negotiated in Congress would’ve applied the tax to several countries. It was in retaliation for those countries not following through on a 2021 global agreement to reduce some taxes on US-based companies that have foreign operations.

In the markets, Big Tech is making a big comeback. I wrote about it in more detail in my Chart of the Day column here. But the move is powerful enough that Nvidia Corp. (NVDA) is close to becoming the world’s first $4 TRILLION company. The maker of advanced semiconductors is benefitting from the surge in Artificial Intelligence-related tech spending, and its ballooning valuation reflects that. As of yesterday’s close, NVDA’s market cap was $3.78 trillion.

Finally, shares of athletic gear and shoe maker Nike Corp. (NKE) are surging after it reported smaller-than-expected declines in quarterly sales and earnings. The firm said it faced $1 billion in tariff-related costs, but that it would mitigate them by raising prices and moving more production out of China. The stock entered today's session down 16% year-to-date.