Stocks are relatively quiet in early trading after a late-day fade yesterday. Crude oil is pulling back, while the dollar is flattish. Treasuries and precious metals are rising. Bitcoin was trading back above $119,000 recently.

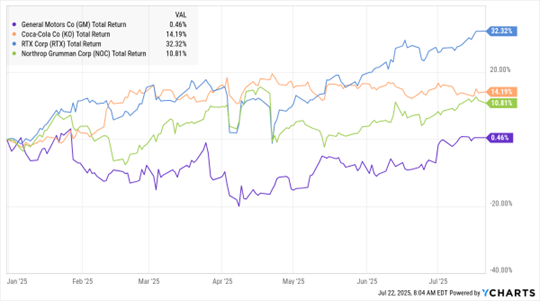

Earnings season is in full swing, with several big-name companies reporting second-quarter profits in the last 24 hours. General Motors Co. (GM) said profit tanked 35% from a year ago to $1.9 billion, with tariffs slicing $1.1 billion off adjusted earnings. While per-share results managed to top estimates, revenue also slipped 1.8% to $47.1 billion amid pricing softness.

GM, KO, RTX, NOC (YTD % Change)

Data by YCharts

Coca-Colo Co. (KO) beat Q2 estimates after raising prices, with earnings up 6% year-over-year on a 2.5% revenue increase. Aerospace and defense giant RTX Corp. (RTX) beat quarterly profit estimates, but lowered its full-year outlook amid rising input costs.

On the flip side, defense contractor Northrop Grumman Corp. (NOC) beat estimates and raised its annual EPS forecast to a range of $25 to $25.40 amid solid sales growth. Earnings growth is running around 5.6% so far, according to FactSet, but that’s with only 12% of S&P 500 companies having reported through last Friday. Results from three of the “Magnificent Seven” companies helped boost the growth number.

Meanwhile, Wall Street is increasingly betting that President Trump will once again back down on trade threats. Fund managers are boosting equity exposure even with the Aug. 1 deadline for trade agreements to be signed approaching because “people have really bought into this belief that there is a Trump put,” in the words of one Invesco portfolio manager quoted by Bloomberg. This comes even as negotiations with key countries like India and economic blocs like the European Union (EU) appear bogged down.