Stocks are giving back some gains in the early going today, as are crude oil, gold, and silver. Long-term Treasuries are slipping, too, while the dollar is modestly higher.

The S&P 500 Index (^SPX) topped 6,500 yesterday – a new all-time high – amid optimism about earnings and economic growth. A revised government estimate showed GDP growing 3.3% in Q2, up from the originally reported 3% gain. Expectations of a Federal Reserve rate cut in September, along with a dip in jobless claims, are also fueling animal spirits on Wall Street.

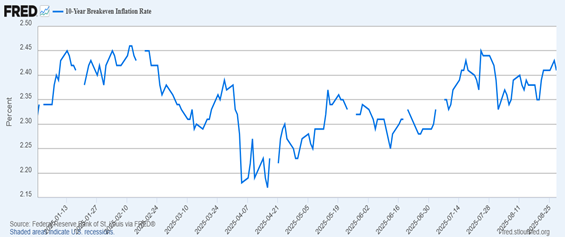

In other markets, gold is closing in on a record high again…while silver is about 50 cents away from topping $40 an ounce. The one fly in the ointment? Longer-term inflation concerns. The yield curve has been steepening, as I wrote a few days ago. Now the 10-year “breakeven rate” is trading around a six-month high.

10-Year Breakeven Rate (YTD)

Source: FRED

That’s the spread between yields on nominal 10-year Treasuries and yields on 10-year Treasury Inflation Protected Securities, or TIPS. Without getting too deep in the weeds, a higher breakeven rate signals that investors are growing concerned that too much easy money and too many rate cuts NOW could lead to worsening inflation LATER. The dynamic is why the iShares TIPS Bond ETF (TIP) is outperforming the iShares 20+ Year Treasury Bond ETF (TLT) – with a year-to-date total return of 6.5% vs. 2.4%.

Another brick was added to the tariff wall overnight. Specifically, the $800 “de minimis” tariff exemption on packages sent from foreign countries ended today. Now, each shipment will get slapped with a levy that will vary based on country of origin. Foreign postal services can also opt to pay a flat fee of $80 to $200 per item for the next six months. Many shippers and foreign companies have halted US-bound shipments or warned about delays and price hikes amid confusion about the tariffing process.

Please Note: Due to the Labor Day holiday, there will be no Top Pros’ Top Picks newsletter on Monday, Sept. 1. Look for your next regular issue on Tuesday. My team and I hope you enjoy the long holiday weekend!