Stocks finished last week on a high note, but they’re giving back ground today. Cryptocurrencies are broadly lower, but gold just surged to a fresh record and silver rose alongside. The dollar is a bit lower along with crude oil prices.

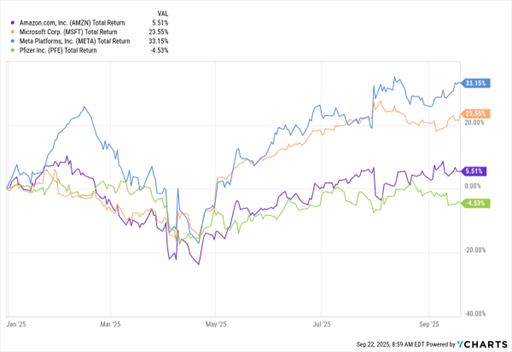

Top US technology companies – and Indian outsourcing firms they work with – scrambled to figure out what to do on the staffing front over the weekend. The catalyst: New Trump Administration rules that would charge companies $100,000 each to bring in specialist foreign workers on H-1B visas. Companies like Amazon.com Inc. (AMZN), Microsoft Corp. (MSFT), and Meta Platforms Inc. (META) are the heaviest US users of the program.

The White House later clarified the fees would apply to new applicants, and only as a one-time fee versus annual. But companies in fields like technology and engineering rely on H-1B workers to fill specialized roles, and will now have to figure out what comes next. Supporters of the change say it will lead to more hiring in America, while detractors say firms will just shift more work overseas to cut costs.

AMZN, MSFT, META, PFE (YTD % Change)

Data by YCharts

Weight-loss drugs are all the rage in the pharmaceutical sector, and Pfizer Inc. (PFE) is trying to cash in. The Big Pharma company said it would acquire Metsera Inc. (MTSR) for up to $7.3 billion in cash and potential future milestone payments in a bid to speed up development of weight-loss treatments. Companies are particularly keen to develop drugs that help patients shed fat without losing too much muscle mass.

ODP Corp. (ODP) – the owner of the Office Depot retail chain – is being taken private. Atlas Holdings is paying $1 billion, or $28 per share, for ODP. That’s a 34% premium to where the shares traded at the end of last week. As more business and consumer customers shifted to buying office products online, the firm struggled. But Atlas will give it a go outside of public market scrutiny.