Gold and silver gave back more ground in the early going after an intense selloff yesterday. Equities and Treasuries are mostly flat, while crude oil and the dollar are rising modestly.

What started as a pullback Tuesday turned into a rout in the precious metals market, with gold sliding more than 6% (and another 3% this morning). That put the metal on track for its worst selloff in 12 years. Silver tanked more than 8% in a single spot market session, its biggest one-day selloff since 2021.

There were no obvious catalysts for the reversal, but metals had gotten wildly extended after the strongest annual rally since 1979. Wild enthusiasm about the “debasement trade” had led to extreme positioning, too. Options trading volume on the SPDR Gold Shares ETF (GLD) just hit its highest ever, while inflows into gold ETFs topped $8 billion last week, the most since at least 2018.

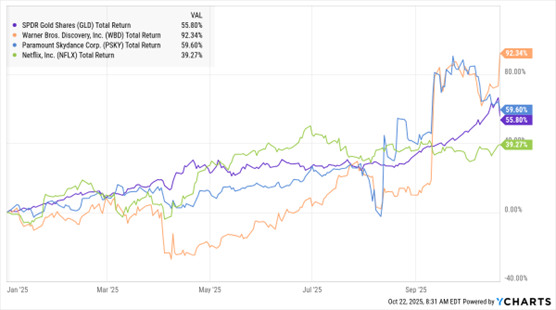

GLD, WBD, PSKY, NFLX (YTD % Change)

Data by YCharts

What’ll happen next with Warner Bros. Discovery Inc. (WBD)? Media industry observers want to know! Paramount Skydance Corp. (PSKY) is reportedly pursuing the movie, streaming, and cable network company, while the firm’s CEO David Zaslav would prefer to split the company in two on his own. Comcast Corp. (CMCSA) is also reportedly in the hunt.

WBD’s streaming business has 126 million subscribers, while its movie and television studios are well-respected. That accounts for the solid interest from other entertainment companies. Speaking of which, Netflix Inc. (NFLX) shares are plunging after the firm whiffed on revenue and profit forecasts in the third quarter. A tax dispute in Brazil of all places hurt results, and some investors remain concerned about engagement and valuation.