Stocks are rallying further after a strong start to the week on Monday. Gold and silver continue to pull back, and today, they’re being joined by crude oil. The dollar and Treasuries are flat.

Amazon.com Inc. (AMZN) is planning big layoffs – at least 14,000 jobs across a range of white-collar divisions like logistics and payments. Though somewhat lower than the 30,000-job tally reported in various places yesterday, that would represent the biggest paring of workers in a few years. Amazon officials said they have to further trim a workforce that grew bloated in the post-Covid era, while also saying Artificial Intelligence (AI) tools will help the company accomplish more with less staff.

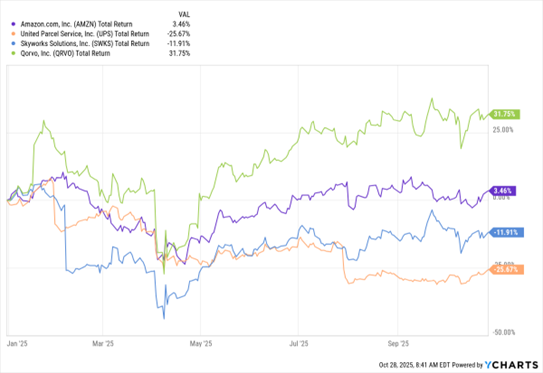

AMZN, UPS, SWKS, QRVO (YTD % Change)

Data by YCharts

Meanwhile, United Parcel Service Inc. (UPS) delivered an earnings home run in the third quarter – aided in part by 34,000 job cuts. The global shipping giant has shut various operations and trimmed its workforce of package handlers and drivers, moves that helped it deliver $1.74 per share in adjusted earnings. Wall Street analysts expected $1.32. The stock jumped 12% in early trading, its biggest gain since February 2022.

On the M&A front, chipmakers Skyworks Solutions Inc. (SWKS) and Qorvo Inc. (QRVO) are joining forces in a $22 billion deal. The companies make analog and mixed-signal chips for the wireless phone and automotive sectors, among others. Skyworks’ shareholders will own 63% of the combined company, while Qorvo holders will own the remainder. Shares of both tech names jumped on the news.

Finally, President Trump’s Asian tour continued yesterday and today with a visit to Japan. Trump heaped praise on Japan's new prime minister Sanae Takaichi, while officials outlined ways Japan would fulfill its pledge to invest up to $550 billion in the US. Next up for Trump is a meeting with the leader of South Korea, followed by the main event – a sit-down with Chinese leader Xi Jinping.