It’s been a rough few days on Wall Street, though stocks look like they’re trying to make a stand here. Gold and silver are also rising a bit, though crude oil is lower. Treasuries and the dollar are mostly flat.

It’s going to be an eventful 24 hours for markets, with Nvidia Corp. (NVDA) reporting quarterly results after the bell. Top Artificial Intelligence (AI) stocks have gotten pummeled in the last few weeks, and NVDA’s numbers and commentary could either stem the bleeding...or make it worse. Analysts expect the company to report $1.25 in Q3 earnings per share on about $55 billion in revenue.

Meanwhile, the government will finally release the September jobs report tomorrow morning. Like many other “official” economic reports, it was delayed by the shutdown, leaving investors (and policymakers) to fly partially blind. Wall Street is looking for a job gain of about 50,000.

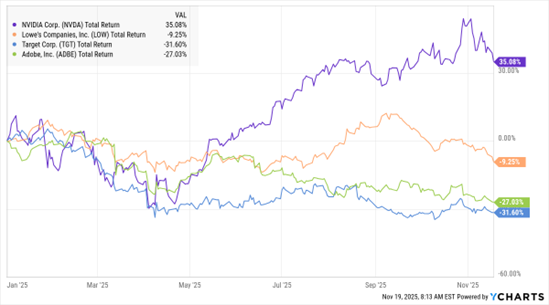

NVDA, LOW, TGT, ADBE (YTD % Change)

Data by YCharts

Lowe’s Cos. (LOW) sang a happier tune than Home Depot Inc. (HD) did yesterday, beating EPS estimates by six cents and saying that digital and contractor sales were healthy. LOW recently spent $8.8 billion to buy Foundation Building Materials, a step designed to increase sales to contractors versus do-it-yourselfers.

Elsewhere in the retail sector, Target Corp. (TGT) reported disappointing results – with same-store sales shrinking more than expected and the company trimming its full-year EPS forecast. The big-box retailer is trying to recapture momentum by spending $5 billion to remodel stores and increase shelf space dedicated to lower-priced seasonal items.

Lastly, Adobe Inc. (ADBE) is reportedly set to buy Semrush Holdings Inc. (SEMR) for $1.9 billion, or $12 per share. That’s a massive premium to SEMR's closing price of $6.76 yesterday. Adobe wants to add Semrush’s software for online advertising, social media research, and other uses to its product lineup, which includes Photoshop and Illustrator, according to the Wall Street Journal.