Stocks are cooling off after a red-hot Friday fueled by dovish Federal Reserve chatter. Gold and silver are easing back along with Treasuries, while crude oil is perking up a bit. The dollar is up modestly.

Merger talk is heating up in the coffee business! Keurig Dr. Pepper Inc. (KDP) plans to buy JDE Peet’s NV (JDEPY), the owner of the Peet’s Coffee chain, for $18 billion. After that transaction closes, the combined company will split itself into two entities. One will focus solely on coffee, and the other will sell sodas, energy drinks, and other products under the Dr Pepper, 7UP, and Ghost brands.

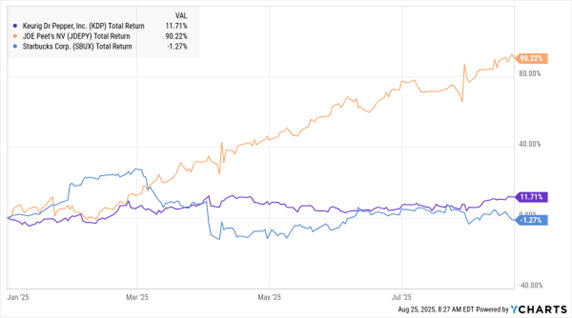

Shares of KDP have done okay for themselves this year, rising almost 12%. JDE has been on fire, though, with its US-traded tracking shares up 90%. For its part, industry leader Starbucks Corp. (SBUX) has struggled amid a revamping of its stores and product line. Its shares are down 1.2% year-to-date.

Data by YCharts

Meanwhile, another energy deal is in the works – this time in the US rather than Canada. Crescent Energy Co. (CRGY) plans to buy Vital Energy Inc. (VTLE) for $3.1 billion in stock and assumed debt. The two shale oil producers are based in Houston and Tulsa, respectively, and the combined company will have a bulked-up presence in the Permian Basin production region. It follows a $5.7 billion deal last week where two Canadian oil sands companies linked up.

Just how incredible has the growth been in the Exchange Traded Fund (ETF) business? More than 4,300 ETFs now trade on US markets – compared with just 4,200 publicly traded individual stocks! A whopping 469 new ETFs hit the markets in the first half of this year, up almost 50% from the same period in 2024, according to Bloomberg Intelligence.

Many ETFs have moved far afield from the old-school “hold a basket of stocks” approach. Investors and active traders can now choose from single-stock ETFs, leveraged and inverse funds, and non-equity ETFs focused on everything from options selling strategies to cryptocurrencies, commodities, and currencies.