It’s still early in the third-quarter earnings season, with only 12% of S&P 500 Index (^SPX) companies reporting results so far. But if analysts are right, four sectors will fuel most of this quarter’s profit growth.

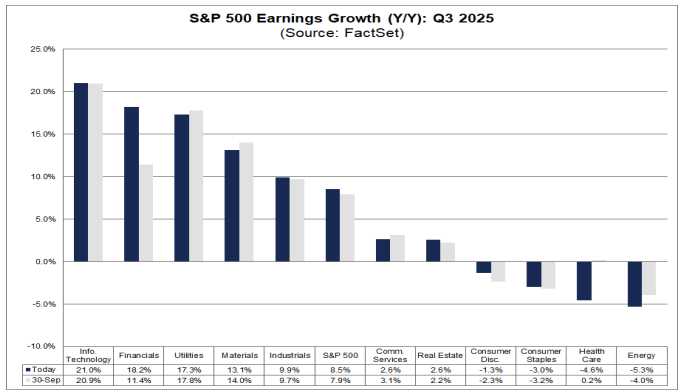

Take a look at the MoneyShow Chart of the Day, which comes courtesy of FactSet. You can see that analysts expect the greatest growth to come from the information technology sector at 21%, followed by financials (18.2%), utilities (17.3%), and materials (13.1%). The worst results will likely emanate from the energy (-5.3%) and healthcare (-4.6%) groups.

Which Sectors Will Drive Corporate Profit Growth in Q3?

Source: FactSet

This week, the pace of reporting will ramp up notably. Roughly one-fifth of S&P 500 companies are going to share their latest results with investors. But at this early stage, 86% of reporting firms have beaten analyst estimates for earnings per share – well above the 10-year average of 75%. FactSet notes that 84% of reporting firms have also beaten sales targets, compared with an average of 66%.

Again, it’s a little early to break out the champagne. But if profit growth does meet or top expectations in key sectors like technology and financials, it could be just the thing to help push stocks higher into year end!

As of late-October, the Technology Select Sector SPDR Fund (XLK) and Utilities Select Sector SPDR Fund (XLU) are showing year-to-date gains of more than 23%, while the Financial Select Sector SPDR Fund (XLF) is up 9%. The SPDR S&P 500 ETF Trust (SPY) has returned 14.3% by comparison.