Commodities came for sale to start the week as a stronger dollar hit the metals complex hard. Energy held up relatively well, but still declined amid risk-off money flows. WTI crude oil futures fell a relatively modest 0.5% to notably end the session slightly below the psychological $60/barrel mark, highlights Tom Essaye, president of the Sevens Report.

Beginning with the relative outperformer, news that crude oil exports were set to resume out of a key Russian port moderately pressured the market, as did the general risk-off money flows across markets.

However, still-elevated geopolitical tensions between Russia and Ukraine…as well as the fluid and still-emerging situation in the Caribbean surrounding Venezuela (and specifically their oil industry)…remained the source of a “fear bid.” That capped the intraday losses at the start of the week.

Looking ahead, oil traders will be keenly focused on both geopolitical “hot spots” to assess any potential impact escalating tensions may have on supply near-term. Additionally, weekly EIA data ahead of the holiday travel season – and the release of key economic data that was previously quarantined due to the government shutdown – may shed light on demand trends.

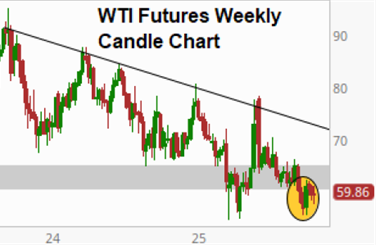

The downtrend in WTI is currently “on hold” due to the combination of geopolitical tensions and macroeconomic uncertainty. That’s leaving prices rangebound between support in the upper-$50s and resistance in the lower-$60s. But the longer-term path of least resistance is still lower, with $50/barrel the next likely stop on the way down.