Featured Content

MARKET MINUTE

Market Minute 2/6/26: Selling Swamps Tech Stocks, Crypto, Silver, & More

MONEYMASTERS PODCAST

MoneyMasters Podcast 2/5/26: Stockton on Market Rotation, Tech Stock Weakness, & More

MARKET MINUTE

Market Minute 2/4/26: Software Stocks Suffer AI Shock

MARKET MINUTE

Market Minute 2/3/26: Palantir Pops, While Musk Merges Companies

TRADING INSIGHTS

Chart of the Day 2/6/26: SaaS-Pocalypse Now

TECHNOLOGY

TRADING INSIGHTS

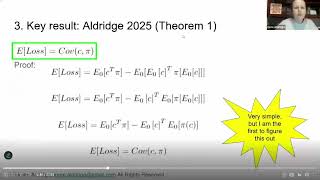

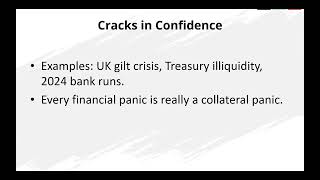

SPX: What Supply, Demand, and Divergence Data Tells Us About the Market

TECHNICAL ANALYSIS

Virtual Learning

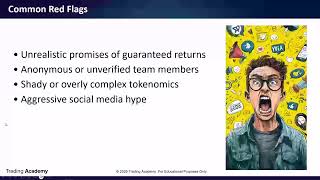

Surviving Bitcoin's Bear Market

BITCOIN

Virtual Learning

Creating a Multi-Layer Defense to Achieve Successful Client Outcomes

TRADING TOOLS

Conferences

Virtual Learning

Virtual Expos

Sponsored Content

A 40-Year Passion and History

MoneyShow has a long history of creating successful investors and traders through timely investing and trading education, delivered by powerful experts who are best-selling authors, market analysts, portfolio managers, award-winning financial journalists, and newsletter editors. With MoneyShow’s interactive environment, our audience of over one million passionate investors and traders are offered a unique format of live, interactive exchange, which generates unparalleled experience for both the expert and the investor and trader.

With constant network expansion, we continue to create broader distribution of our expert commentary through virtual events, face-to-face forums, social media, and in-depth courses that educate and guide qualified investors and traders to outperform the market. Each session energizes, empowers, and educates everyone who participates. The opportunity for learning and profit within this highly charged atmosphere draws hundreds of thousands of enthusiasts, year after year.

View Courses