Tobacco stocks are showing better technical performance than the weak market, as hefty dividend yields attract buyers. However, be aware that they could be dragged down by the general market, and by further regulatory changes in the US, observes MoneyShow.com contributor Kate Stalter.

It's typical in poor economies for defensive sectors to climb, as I noted in this column last week. One industry that's been running to the head of the line lately is tobacco, something that's largely left crumbled up in the ashtray in better times.

It's one of those industries that many investors object to-and that includes institutions with social mission statements. But apparently enough others are not bothered by any moral implications, and have been sending the stocks higher while other sectors are tanking.

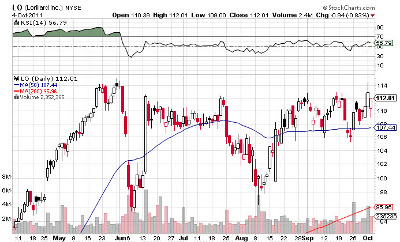

One of the sector leaders has been Lorillard (LO), the North Carolina-based maker of brands such as Newport, Maverick, Kent, True, and Old Gold cigarettes. The stock has trended above its ten-week line in recent weeks, although trade has been choppy, in keeping with the character of the broader market.

Lorillard has a market cap just north of $15 billion, and it moves about 1.8 million shares a day, but it has tended to show wider price swings than many larger stocks.

It has strong institutional ownership, thanks in part to its being the top component in the iShares Dow Jones Select Dividend Index Fund (DVY). It's also a significant holding of the American Funds Capital Income Builder Fund (CAIBX).

Lorillard's biggest seller is its Newport menthol brand. The stock began a huge uptrend earlier this year after the FDA failed to institute an outright ban on menthol cigarettes, even though the agency said "removal of menthol cigarettes from the marketplace would benefit public health in the United States."

Some analysts believe the company may still face some blowback if the FDA does eventually decide to ban menthol cigarettes or place new restrictions on the product. Goldman Sachs cut Lorillard's rating to Neutral from Buy on Tuesday, citing concerns about menthol regulation.

The stock fell on Tuesday, but volume was below previous levels of upside trade. Declines following an analyst downgrade are frequently short-lived, as institutional holders opt to scoop up more shares at a lower price, thereby sending the price back up.

A possible factor in Lorillard's favor is a relatively new CEO. Murray Kessler took the reins in September 2010. New management often brings fresh ideas that can result in better fundamental and technical performance, even in a not-so-new company like Lorillard.

In addition, the company is often viewed as a possible acquisition target, which may help bolster share price in comparison to industry peers over time. Lorillard has a dividend yield of 4.7%, another factor making the stock attractive in the current market.

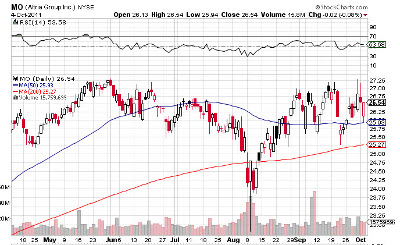

Another tobacco company that's held up well is fellow DVY component Altria (MO). The company formerly known as Philip Morris is also operating in a difficult US regulatory environment, but recovered fairly well from an August swoon.

Its best known brand is flagship product Marlboro. As of Tuesday, the stock was getting support at its 200-day moving average.

Threats of litigation and further regulation could be long-term weights on tobacco stocks, but as defensive plays, they've found a role. Altria's dividend yield currently stands at 6.3%, though of course that would decline if share price rose.

The rate of quarterly sales has been slowing recently, and analysts don't expect that trend to change in the next two quarters. Altria could be a dividend paying option for investors at this juncture, but its technical and fundamental performances both lag that of Lorillard.

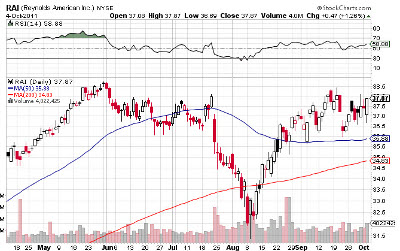

Reynolds American (RAI) boasts a better chart than Altria, at the moment. It, too, rebounded after a steep decline in August, and is holding above key moving averages, although it's trading about 6.5% below its May all-time high of $39.87.

Trading volume has been below average in recent weeks, not a resounding endorsement of institutional confidence in the stock.

Reynolds' product lines include Camel, Kool, and Pall Mall. The company has been growing sales in the category called smokeless tobacco-though it's most often called "snuff" or "chew." The company also owns the Santa Fe natural tobacco brand.

Though recent price action in Reynolds has outpaced the broader market, here, too, the dividend is likely attracting more buyers than the growth potential. Analysts see the company earning $2.65 a share this year, a gain of 6% over 2010. In a bull market, that would not typically be enough of a draw to boost a stock to market outperformance.

While investors have flocked to defensive names, tobacco stocks have held up better than the general market, although not exactly lighting up.

Be aware that even tobacco names fell sharply in the 2008 and 2009 bear market, so even defensives are not immune to sharp sell-offs when panic sets in.

At the time of publication, Kate Stalter did not own positions in any of the investments mentioned in this column.