With unusually strong year-to-date gains, observers of the well-known Santa Claus Rally might be worried that Santa may have already come to town, jests market historian and money manager Jim Stack, editor of InvesTech Market Analyst.

The Santa Claus Rally is one Wall Street truism that is supported by historical data.

However, since 1970, year-end rallies have started earlier, as investors purchased equities in anticipation of year-end seasonal strength, and have been stronger due to the influx of year-end retirement plan contributions.

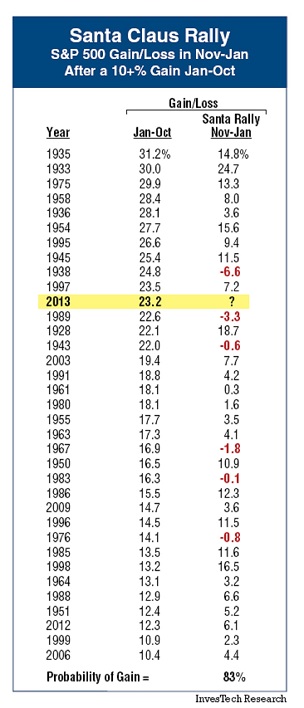

In historical comparison, 2013 has experienced the 11th best January-October gains of the past 85 years. Yet, surprisingly, that doesn't rule out a potential Santa Claus Rally.

Digging a little deeper, we find that double-digit gains from January to October actually increase both the profitability and probability of the Santa Claus Rally.

The table below shows the years with double-digit gains from January to October, alongside the subsequent gain/loss for the Santa Claus Rally period (November 1 to January 31).

From reviewing this chart, it is notable that:

- 83% of the instances were positive (compared to less than 50% during years when there was a loss from January-October).

- The average gain was +6.7%—with almost one-third of the Santa Rallies enjoying double-digit gains.

- During years when Santa failed to come to town, the average decline was -2.2%, with only one instance of a decline greater than 5% (1938: -6.6%).

With historical odds like these, it's quite possible that we'll continue to see further gains through this holiday season!

Subscribe to InvesTech Market Analyst here…

More from MoneyShow.com:

Straight Scoop on the Santa Claus Rally