Bear markets are not to be feared. They are the times when you get to “buy low”, It’s a time when disciplined investors take advantage of fear in the markets that always is later shown to be over blown, explains income specialist Tim Plaehn, editor of The Dividend Hunter.

Income focused investors get to buy in at very attractive yields and benefit from capital gains as the overall market recovers into the next bull market.

In these days of falling stock prices you want to find dividend paying stocks that are built for tougher economic times. Here are two to consider.

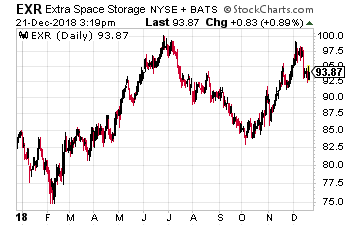

Self-storage REITs are the place to be when the economy gets rough for home ownership. Extra Space Storage (EXR) is a large-cap, geographically diversified self-storage REIT.

The self-storage business is counter-cyclical to the economy. When the economy is booming, developers bring a lot of new inventory into the market. When the economy slows, the inventory growth stops and demand increases.

Extra Space Storage is possibly the best managed REIT in the sector. Investors can expect high single digit annual dividend growth. The current yield is 3.7%.

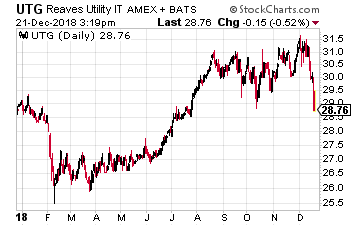

Utilities are supposed to be the safe sector when the stock market goes into a correction. This time utilities are down right along with the rest of the market sectors. Now is a great time to pick up shares of the Reaves Utility Income Fund (UTG).

This is a closed-end fund that owns utility and other infrastructure stocks. UTG has paid a steady and growing monthly dividend since it launched in 2004. The dividend has never been reduced and the fund has never paid return-of-capital dividends. The current yield is 6.9%.