Marvin Appel, MD, PhD, asserts that this should be a good year to increase exposure to international equities. He is president of Signalert Asset Management LLC, and an expert in timing models.

State of the Market: The S&P 500 Index is retesting its March 27 lows after staying in an unusually narrow range over the past three weeks. Our equity models remain overall neutral-positive for the intermediate term, which means that risk remains well-contained. However, if the market continues to move sideways or to weaken, our models will downgrade from neutral-positive to neutral at the beginning of May, which would be a signal to reduce equity exposure. For now, I expect stocks to hold their ground.

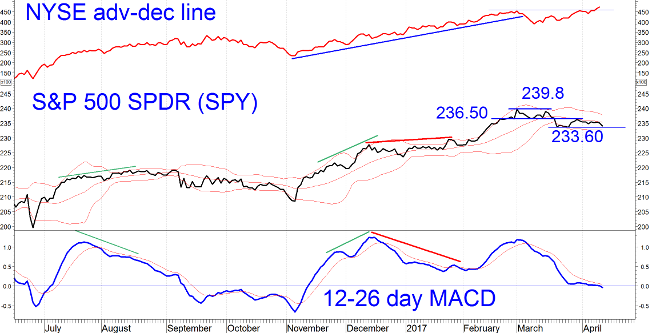

The chart of SPDR S&P 500 ETF (SPY) shows that it has been below the middle Bollinger band (20-day moving average) for almost four weeks. This is the weakest that SPY has been since before the election and signals a change in the near-term trend from up to sideways at best.

For the past three weeks, MACD has been scraping the zero line—very unusual. Overall, the sideways to lower price action and MACD do not give much clue as to which way stocks will break out. Fortunately, market breadth is positive, with the advance-decline line making new highs. The most likely scenario is for SPY to stay near or above the $233.60 support area for the next three weeks or so, although a small temporary penetration to a new low is possible.

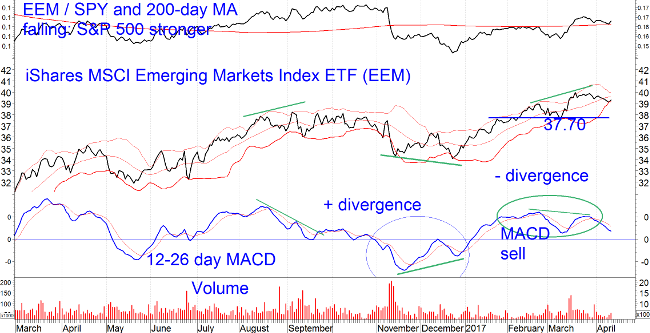

It is not only US equities that have lost their momentum. The chart of the iShares MSCI Emerging Market Index ETF (EEM, daily) shows that it has formed a negative divergence with its MACD: MACD and EEM made new highs in February, but while EEM hit another new price high in March its MACD did not revisit its February peak levels. This is potentially bearish over the next several weeks. On the other hand, EEM is now sitting on potential support at the lower Bollinger band, around $39.

I am long term bullish on foreign equities. For now, EEM has hit a soft patch but should find strong support between $37.70 and $39. In the current decelerating market climate, I recommend writing covered calls on EEM if you can buy the underlying shares below $38.50. Write calls that expire in one to two months, which at current market conditions should return at least 1% per month in time value. (For example, with EEM at $39.31 the $39 calls expiring 6/16/2017 are $1.30 bid, representing a maximum potential gain of $0.99, 2.5%, between now and expiration.)

Recently, we saw that European equities (IEV) were in a solid uptrend, which remains the case. Also, currency risk seems to be behind us with the Euro forming what appears to be a base within a trading range of $1.04-$1.08 over the past five months.

Bottom line: This should be a good year to increase exposure to international equities.

Interest rates retesting their lows.

10-year Treasury yields are retesting their post-election lows of 2.3%. (See chart.) This is an intermediate-term overbought level for investment-grade bond prices and I do not recommend chasing this rally. It may, however, pay to buy investment-grade bonds in the event of a retracement back up to 2.6% or more on 10-year Treasury yields, betting on a continuation of the five-month-old trading range. Our investment-grade bond model remains on its Oct. 21 sell signal.

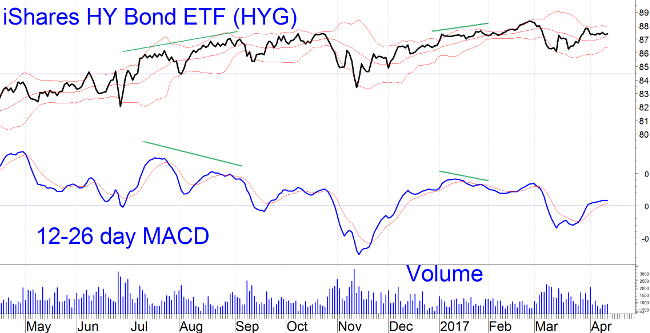

High yield bond prices are moving sideways, with MACD at neutral, near zero. (See chart.) I expect continued sideways movement of high yield bonds, which means that you would be earning interest all the while. These, and floating rate bond funds, appear to be the most attractive areas in a richly priced bond market right now.

Subscribe to investment newsletter Systems and Forecasts here….