The Emerging Markets Timer is our disciplined method for staying on the right side of the emerging markets. The Timer is bullish when the index is above the lower of its two moving averages and that moving average is trending up, explains Paul Goodwin, editor of Cabot Emerging Markets Investor.

Our Emerging Markets Timer is still bullish, but the next few days will be telling. The iShares EM Fund (EEM) isn’t in terrible shape — it’s just 2.5% or so from a multi-year high — but this week’s retreat has brought it down to its 50-day line for the first time since early March.

So far, this action is acceptable and, combined with the resilient action from most of our stocks, keeps us bullish. But we’ll be watching things closely in the days ahead, as much more weakness could produce a sell signal and have us trimming our sails.

The good news is that most of our recommended stocks are acting just fine, with most remaining in solid uptrends.

Alibaba (BABA) surged to a multi-year high today on excellent volume, a great sign of relative strength. The stock’s story, numbers and chart all point toward higher prices once the market’s longer-term uptrend resumes. Earnings are likely out in early May. BUY.

Momo (MOMO) isn’t well known, yet it probably has as much potential as any stock in China right now. Demand for the firm’s new video services is going bananas, driving wild growth (revenues were up 524% last quarter!) and crushing earnings estimates.

While the stock is very volatile, we’re extremely impressed with how MOMO has held up (it surged to new highs last week before retreating a bit in recent days) given its huge run since December.

If and when the market kicks into gear, we think MOMO could do very well. Hold on if you own it, and if you don’t, consider buying a little here or (preferably) on dips of a point or two. BUY.

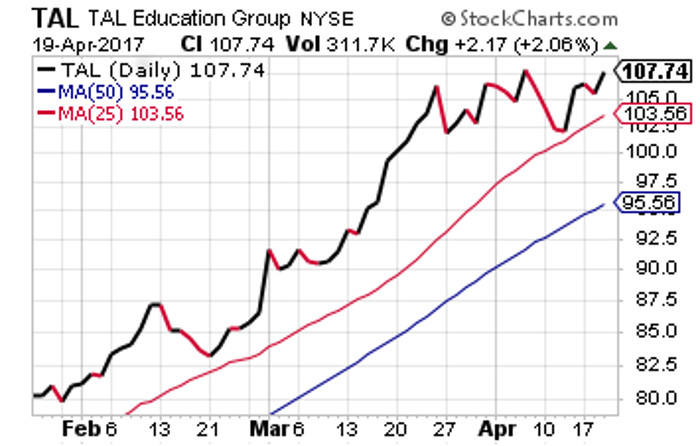

TAL Education (TAL) has encountered some distribution in the mid-100s during the past couple of weeks, though that’s not unusual given the market’s wobbles. So far, shares have held the 25-day line, so it’s not as if the sellers have made much headway.

The big event will come next Thursday (April 27), when earnings will be released—analysts are looking for revenues to rise 65% and earnings of 30 cents per share (up 30% from a year ago). Keep any new positions small ahead of the report. BUY.

Subscribe to Paul Goodwin's Cabot Emerging Markets Investor here…