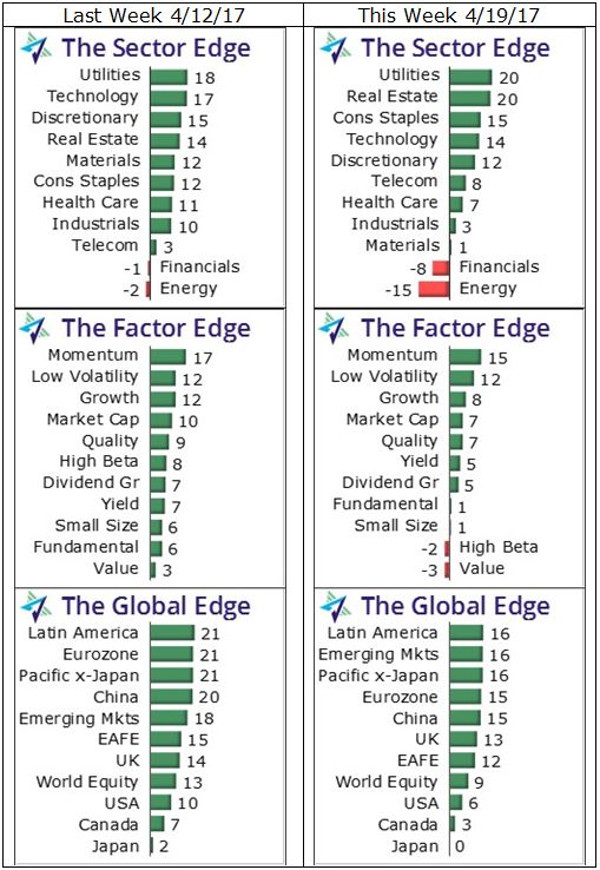

Defensive sectors are on the rise and already control the top of the rankings, explains ETF sector analyst Ron Rowland, editor of Invest with an Edge.

Real Estate, one of the new-era defensive sectors, has joined Utilities at the pinnacle, and the traditional defensive sector of Consumer Staples sits in third. None of the factor ETFs were able to increase their momentum scores this past week, and the top of the global rankings remains a tight race.

Sectors: Last week, the primary discussion was the rise of Real Estate, as it climbed four spots higher and into the upper echelon. Today, Real Estate sits two notches above last week’s position, and it is now in a tie with Utilities for first-place honors. Traditionally, the “defensive sectors” consisted of Utilities, Consumer Staples, and Health Care.

The reasoning behind this was that these were the sectors where consumers had to make expenditures even when the economy was bad. Their defensive nature typically resulted in them declining less than other segments during bear markets. However, what investors classify as defensive can change over time.

The Telecom sector is often lumped in with this group because it has many of the characteristics of Utilities along with an above-average yield. Real Estate can be viewed as defensive since it can mitigate the effects of inflation in addition to its high dividend yield.

Given these descriptions, it is clear that the the Sector Benchmark ETFs are in a defensive posture, with Consumer Staples sitting right below the leaders.

Additionally, Telecom climbed three places higher. Health Care, sitting in seventh, is the odd man out, which is likely due to its high degree of political risk at this time.

Technology, Consumer Discretionary, and Materials fell in the rankings to accommodate the rise of the defensive sectors. Financials and Energy are still the only two sectors posting negative momentum scores, and this week they have fallen deeper into the red.

Factors: Unlike the show of strength among the defensive sectors, none of the Factor Benchmark ETFs were able to post a momentum increase this week. The five highest-ranked factors remain identical to a week ago, with Momentum and Low Volatility sitting in the #1 and #2 spots, respectively.

Yield and Fundamental were both able to climb two positions, but they remain in the lower half of the rankings. High Beta was the only factor to fall in relative strength, and it dropped four places lower. Additionally, High Beta and Value slipped into negative momentum territory.

Global: The virtual three-way tie for first place among the Global Benchmark ETFs that was visible last week is there again today, although it is not composed of the same three categories. Latin America and Pacific ex-Japan are the two that held their spots, while the Eurozone dropped slightly out of contention and was replaced by Emerging Markets.

Do not read too much into this, though, as a scan of the momentum scores reveals just a single-point difference among the top-five categories. With the score compression this high, the rank order has little significance.

The U.K. and EAFE swapped places, producing the only changes in the lower half. All global categories lost momentum, and the U.S. dollar lost strength against most foreign currencies, keeping the U.S. near the bottom of the rankings. Japan is on the bottom for a second week and is barely treading water.

The following Edge Charts are market momentum snapshots. They provide a quick and easy way to help you visually get a handle on the overall state of the market. With these charts, you can assess both the relative strength and absolute strength (momentum) of more than 30 global equity market segments.