The SPDR DoubleLine Total Return Tactical ETF (TOTL) is an actively managed bond fund with a strong reputation and a broad scope of investment options subject to the decisions of DoubleLine Capital, explains Jim Woods, ETF expert and editor of The Deep Woods.

It can broaden its focus to include or not include international investments in general, as well as specific countries. This relatively open take on exchange-traded fund (ETF) management is relatively uncommon and may be interesting for bond investors.

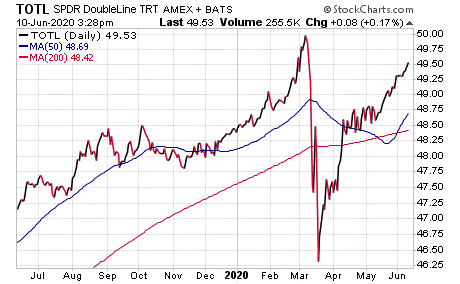

Naturally, as a bond fund, the ETF’s price is fairly stable. Indeed, the March market volatility did not affect this fund nearly as much as it did the broader market, and it is up 0.98% year to date. TOTL manages over $3 billion in net assets.

It pays out a 3.21% yield and has an expense ratio of 0.55%, which is not the lowest in the field by any means but could be considered fair in light of the fund's active management.

Currently, the fund is heavily allocated to U.S. Treasury bonds and other U.S. government-based holdings, with some smaller positions in domestic corporate debt.

If you’re looking for a stable bond fund with a bold reputation and an expert active hand to add to your portfolio, the SPDR DoubleLine Total Return Tactical ETF could provide the payouts you seek.

Subscribe to The Deep Woods here…