An exchange-traded fund recently has been created to specifically reflect the importance of corporate social responsibility, notes Jim Woods, editor of The Deep Woods — in the second of 3 articles on socially responsible ETFs.

Although the topic of corporate social responsibility is not a new one, it has gained considerable traction since the advent of the 2008 financial crisis as many people have blamed corporate greed for throwing millions of people out of work and into foreclosure when they could not pay their mortgages.

Similarly, opinion polls, such as the 2019 JUST Capital survey, have revealed that Americans, regardless of age group, political affiliation and income level, care a great deal about worker pay and well-being, customer treatment and privacy, beneficial products, preserving the environment and job creation.

Read part 1 of this article here.

The Goldman Sachs JUST U.S. Large Cap Equity ETF (JUST) tracks an index of U.S.-listed large-cap stocks that are selected through the use of a survey that ranks companies for their practices vis a vis environmental, social and governance issues.

Specifically, this fund tracks the JUST U.S. Large Cap Diversified Index, which is made up of the top 50% of Russell 1000 companies in each industry. The companies are then rated according to JUST Capital’s survey results.

According to JUST Capital, when compared to the companies that are excluded from the index, the companies that remain listed are, for instance, more likely to pay their workers a living wage, create jobs in the United States at a greater rate, produce less greenhouse gas emissions, give more to charity and pay less in fines for unethical behavior.

This ETF’s launch also was a stunning success, as the fact that it ended its first day of trading with $251 million in assets catapulted it into the echelons of the top 10 equity ETF launches in history.

Some of this fund’s top holdings include Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Facebook (FB), Alphabet Class C (GOOG), Alphabet Class A (GOOGL), Johnson & Johnson (JNJ) and Visa (V).

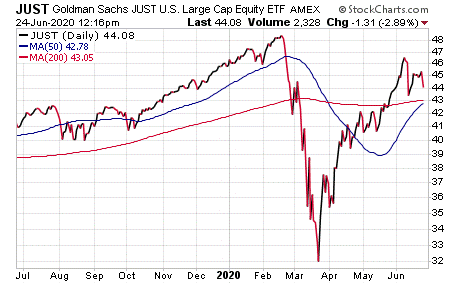

This fund’s performance has risen after the recent market downslide. As of June 23, JUST has been up 6.70% over the past month and up 40.88% for the past three months. It is currently down 1.62% year to date.

Chart courtesy of www.stockcharts.com.

The fund has amassed $128.19 million in assets under management and has an expense ratio of 0.20%. In short, while JUST does provide an investor with a chance to merge a desire to profit with the need to sate one’s conscience, this kind of ETF may not be appropriate for all portfolios.

Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.