European markets have been slumping for years, but the time for those countries to shine again may finally be around the corner as potential investments and renewed growth in European economies is beginning to take off, suggests Jim Woods, fund expert and editor of The Deep Woods.

SPDR Portfolio Europe ETF (SPEU) is about as close to a pure Western European investment vehicle as you can get, and it includes both large- and small-cap companies, though holdings are weighted by market cap. It is a simple idea aimed at investors who are looking to invest in the region broadly.

Over the last 12 months, this fund is down 6%. This is similar to the performance of other funds with similar investment theses, such as Vanguard FTSE Europe Index Fund (VGK).

Western Europe has underperformed American markets over that time period, just as European markets have for years. SPEU holds $137 million in net assets. Its expense ratio is a fair 0.09% and it pays a current 2.36% dividend yield.

Chart courtesy of StockCharts.com

SPEU's holdings cover a broad swath of industries. Its top holdings, by nation, are the United Kingdom, Switzerland, France, Germany and the Netherlands, though a number of other European countries are represented as well.

The top five largest individual holdings are Nestle SA, 3.36%; Roche Holding AG, 2.50%; Novartis AG, 2.20%; ASML Holding NV, 1.66%; and SAP SE, 1.61%. The top 10 holdings make up 17.5% of SPEU's portfolio.

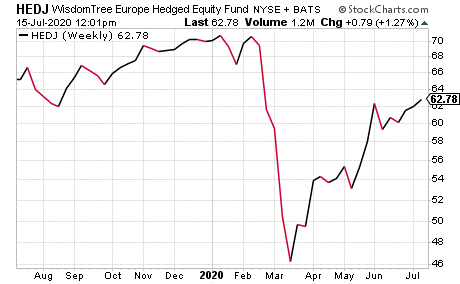

The WisdomTree Europe Hedged Equity Fund (HEDJ) seeks to provide exposure to the European equity market while hedging against fluctuations between the U.S. dollar and the euro.

The fund is hedged against the euro for U.S. investors. HEDJ targets dividend-paying firms, and, as the ticker implies, aims to remove euro currency exposure for the benefit of investors who are based in the United States.

In a weakening euro scenario, the hedge seeks to protect local gains from getting lost in the conversion back into U.S. dollars. In a strengthening euro environment, the fund is designed to safeguard against poor local returns and no foreign exchange gain. Effectively, HEDJ doubles down on its bet against the euro.

The fund charges a hefty fee, but it has had no trouble attracting assets. Consequently, it is one of the most liquid ETFs in the developed European space, making it ideal for short-term tactical trading.

Investors may want to consider trading in the morning (New York time), when European markets are still open, for the best price.

Source: StockCharts.com

The fund has $2 billion in assets under management, 103 holdings and an average 0.02% spread. It has a 1.52% distribution yield and an expense ratio of 0.58%, meaning that it is more expensive to hold in comparison to many other exchange-traded funds.

To sum up, HEDJ tracks an index of Eurozone dividend-paying companies that derive a majority of revenue from exports outside that zone. This fund could be beneficial for short-term tactical traders, but please exercise your own due diligence in deciding whether or not this ETF is suitable for your individual investing and portfolio goals.

During times of market tumult, many investors choose to purchase shares in companies that have a history of stable dividend growth to secure reliable dividend payouts.

Studies by Ned David Research, among others, have lent empirical support to this strategy as scholars have found that both domestic and international companies whose dividends increased year-over-year for the past 20 years outperformed companies whose dividends either remained flat or decreased.

A problem with this plan is discovering the companies that have such a history, as predicting which ones are best suited to endure the unpredictable shocks that the world generates without cutting or eliminating the dividend payouts.

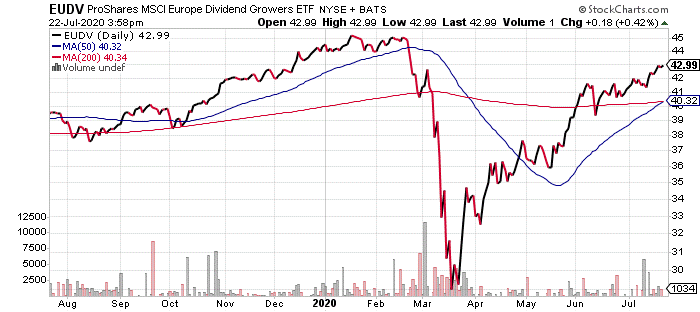

Thankfully, an ETF called the ProShares MSCI Europe Dividend Growers ETF (EUDV) exists to simplify such an undertaking. EUDV tracks an index of European companies that have a history of stable dividend growth.

To avoid excessive risk-taking as a result of having a limited amount of holdings, all of the assets in EUDV’s portfolio are given equal weight.

Some of this fund’s top holdings include UCB SA; SEB SA; Ashtead Group plc; Partners Group Holding AG; Legal & General Group Plc; St. James's Place Plc; and SSE plc.

This fund’s performance has risen after the recent market downslide. As of July 21, EUDV has been up 4.99% over the past month and 22% for the past three months. It currently is down 3.59% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $7.86 million in assets under management and has an expense ratio of 0.55%. It offers a current dividend yield of 1.59%.

While EUDV does provide an investor with a chance to tap into European companies with a history of stable dividend growth, this kind of exchange-traded fund may not be appropriate for all portfolios.

Thus, interested investors always should conduct their due diligence and decide whether this fund — and the others reviewed above — are suitable for their investing goals.