August has been the worst DJIA, S&P 500 and NASDAQ month of the year since 1988, cautions Jeffrey Hirsch, an industry leading authority on seasonal market timing and editor of Stock Trader's Almanac.

However, August’s track record in election years since 1950 (DJIA & S&P 500) or 1971 (NASDAQ) is much better. Average election year August performance ranges from 0.7% by DJIA to 3.3% for Russell 2000 (since 1979).

This election year could be different since the pandemic has changed the date and structure of the conventions which have historically taken place in July.

There has been a bit of chatter out there about how Q3 of election years is the best performing quarter of the entire 4-year presidential stock market cycle. But that study uses data going all the way back to 1900 when the world was a much different place with much of the economy driven by agriculture.

Our studies show that all the election year Q3 outperformance transpired before WWII with an average DJIA gain of 11.1% from 1901-1948. However, from 1949-June 2020 election year Q3 averaged DJIA gains of only 0.7%, ranked 11th of 16.

Also any improvement to August and September performance during election years is attributable to the buzz and excitement around the conventions. Nowadays campaigning goes on pretty much nonstop.

The rally off the pandemic low has put the market back at lofty levels again. With most of the good news baked in, the market will be hard-pressed to add significant gains over the next 2-3 months without some major virus breakthroughs and a return to more normal economic activity.

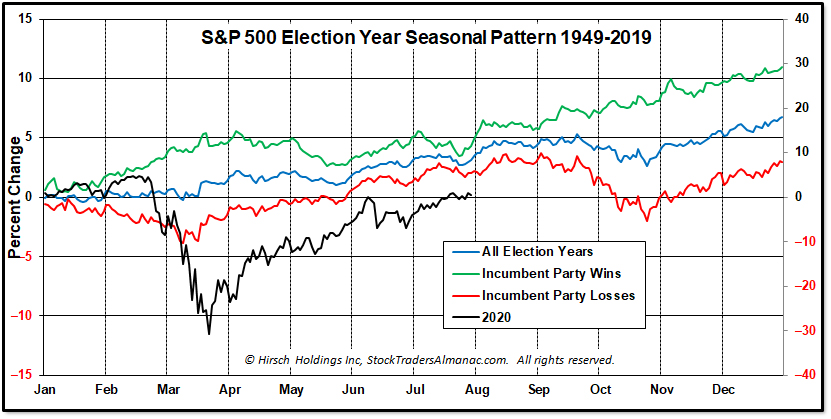

Checking the accompanying updated chart of election years tracking 2020 S&P 500 performance versus all election years and incumbent party wins and losses — as well as the polls — suggests that President Trump’s reelection is not a forgone conclusion.

/p>

/p>

In fact S&P 500 is tracking the incumbent loss trend more closely. But that of course remains to be seen.

Market performance over the next three months is critical to President Trump’s reelection bid and you can be sure he is well aware and will do everything in his power to boost the market as all incumbents generally do.