The U.S. Global Jets ETF (JETS) is an exchange-traded fund that traverses the world, as it invests in both U.S. and non-U.S. companies involved with the airline industry, notes ETF expert Jim Woods, editor of The Deep Woods.

Companies within this fund are not solely passenger airlines, but aircraft manufacturers and airports and terminal services companies as well. JETS is a diverse ETF comprised of small-, mid- and large-cap companies throughout the United States and the world.

About 70% of the fund is weighted towards U.S. large-cap passenger airlines. It uses a tiered-index weighting methodology driven mostly by market cap and passenger load.

The rest of its portfolio, both national and international, is populated with companies in supporting industries. These supporting companies are chosen according to basic factors such as gross margins, sales growth and sales yield.

JETS has an expense ratio of 0.60%, a yield of 2.35% and $1.40 billion in assets under management. Year-to-date, the fund’s total return is down 48.70%. However, this is an understandable drop.

This ETF is centered around all things pertaining to flight, which has been one of the most downtrodden sectors since March due to COVID-19.

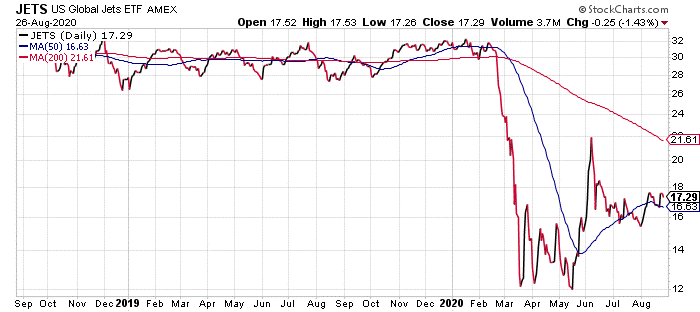

A glance at the chart shows the strength of the fund prior to COVID-19. Though it dipped sharply in early March, JETS gained its footing in early June and is now on a steady, mid-level trend.

Chart courtesy of www.stockcharts.com

The majority of JETS’s portfolio is made up of stocks, and its top five holdings are Southwest Airlines (LUV), Delta Airlines (DAL), United Airlines Holdings (UAL), American Airlines Group (AAL), 8.45% and Allegiant Travel (ALGT).

It may be a bit of a surprise to some investors to learn that U.S. Global Jets ETF is in the global transportation segment, as the majority of its weight is held in U.S. stocks. However, it earned its spot in this segment because it runs the gamut from airline companies to manufacturers and service firms.

This fund may be worth considering if it meshes with the goals of an individual investor. For investors looking to place themselves firmly in all things sky bound, JETS offers a direct approach.