While investors have many reasons to love utilities, they often don't like betting on single names. This is where Reaves Utility IncomeFund (UTG) comes in, explains Rida Morwa, income expert and editor of High Dividend Opportunities.

Reaves Utility — a closed-end fund — is a favorite of ours. It invests in utilities and infrastructure companies. It aims to provide a high level of after-tax dividend income. Since inception the fund has done quite well and beaten funds in its category over 3, 5 and 10-year time frames rather handily.

UTG has lagged recently and we consider that as a chance to pick some alpha in the future rather than a reason to dump this fine-performing fund. Since inception it has also beaten the Utilities Select Sector SPDR ETF (XLU) by 40% in total returns.

While that is an impressive amount, what is even more impressive is that it has done so while doling out tons more in income every year for its investors. Now the income return is factored into the total return calculation above.

However, what we want to note is, that it is much harder for funds to generate high total returns and keep up with similar ETFs, while paying out a higher income than the underlying holdings generate.

This requires exceptional planning and timing, and it is often the reason that CEFs that do this will lag the indices. So UTG's performance must be appreciated in that light.

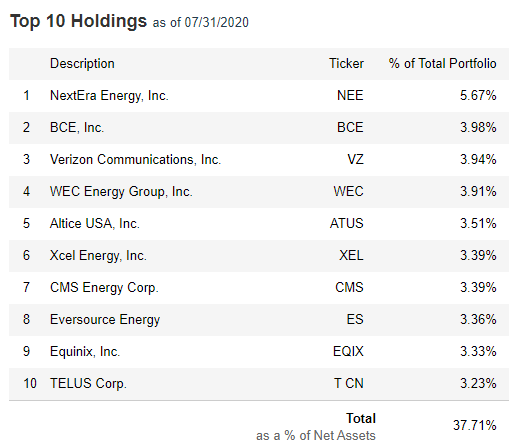

UTG runs a fairly concentrated fund with top 10 holdings making up about 40% of the total assets:

While some investors fret this, we are never too concerned as UTG forms but one of our many holdings. Our final exposure to any name within the fund is minuscule as a result. While the fund stays pretty much in the US, it has some holdings outside that.

UTG's strength lies not only in its yield but the fact that they are one of the few funds that has never needed to cut their distribution. Indeed, they made it though the 2008-2009 recession while maintaining their distribution.

The fund currently yields 7% and while that is not the stellar bargain we saw mid-March, it is certainly in line with where this fund has historically traded.

The fund has delivered an impressive performance and done so with little fanfare. The fund currently trades at a small premium and the amount is so small that it is inconsequential.

We would pick it up here and every time it went at a discount. With the broader market obsession with technology and communications, we believe valuations have pushed so far into the stratosphere that negative returns are guaranteed for many sectors on a longer-term time frame.

On the other hand, utilities are trading at 7% earnings yields with many dividends exceeding 4%. It is not hard for us to envision that this will be one of the few sectors that actually delivers 7% plus returns, which is precisely what pension funds need. Ignore the shorter-term headwinds and play this sector via Reaves Utility Income Fund.