The market is taking on a tone of consolidation along with caution regarding further Congressional stimulus, China tensions and pre-election uncertainty, asserts Bryan Perry, income expert and editor of Cash Machine.

Volatility is on the rise, making for a good environment to collect premiums through the sale of call options. Hence, I see good value and risk/reward in adding a covered-call equity fund whose portfolio is skewed to many of the market’s current strengths.

The Madison Covered-Call & Equity Strategy Fund (MCN) fits the profile I’m looking for from timing and an attractive portfolio composition. The fund pays a quarterly dividend with an annual yield of 12.12%.

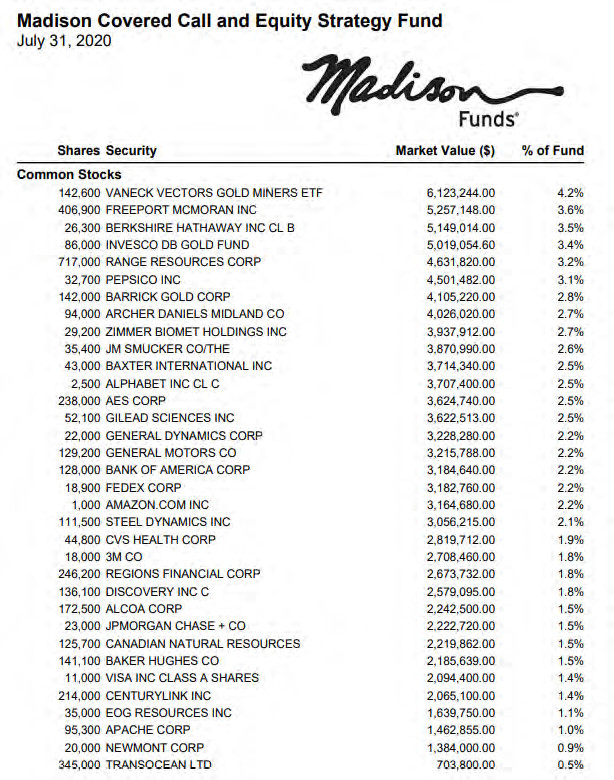

When I saw the makeup of the portfolio, I was immediately impressed. I want to raise our exposure to hedging against skyrocketing federal debt and a weaker dollar. Three of the top four holdings in MCN are gold-related assets.

Other top 10 holdings include very defensive stocks like Berkshire Hathaway (BRK.B), Pepsico Inc. (PEP), Becton Dickenson & Co. (BDX), a pure play on the rally in natural gas Range Resources Corp. (RRC) and a 5G play in Xilinx (XLNX).

Like any investment, my aim is to buy into a strategy that focuses on capital inflows and is also a good steward of the assets under management. The fund mangers at MCN don’t use leverage and have about 26% of assets in cash.

Below is the most recent publication of what the fund holds. It’s a solid blend of blue-chip stocks that offer plenty of potential upside appreciation that will complement the double- digit yield generated by the covered-call strategy.

Since the fund pays a yield of 12.12%, it will reside in the Extreme Income Portfolio. Let’s put this high-yielding asset to work for us; buy MCN under $6.50.