Our quarterly tradition of rising dividend with American Tower (AMT) continues, asserts income expert Brett Owens, editor of Hidden Yields.

The cell phone tower landlord has just recently raised its quarterly dividend to $1.14 per share (from $1.10). This marks a 3.6% raise from its previous payout and a sweet 20% year-over-year increases.

American Tower really is an ideal social distancing stock. Plus, it has a 5G kicker to boot! As you can imagine, its cell towers are working these days with many of us sitting at home, staring at our phones and desperately searching for something to entertain us.

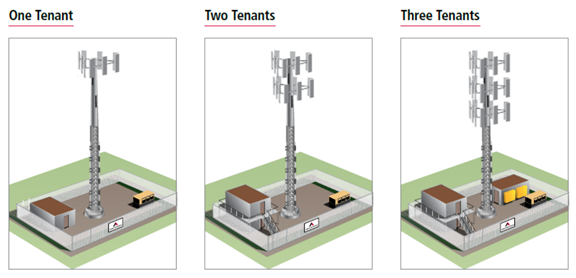

AMT is a capital-intensive business to start from scratch, but once the towers are built, they “scale” quite easily. Check out the illustration below to see what it takes for a tower to support one or two additional tenants — it’s as simple as bolting some additional equipment on!

The return on investment (ROI) AMT generates from a “one tenant tower” is just 3%. However, this jumps with each additional tenant, with ROI increasing to 13% for two tenants and an awesome 24% for three tenants.

We’ve now banked $6.80 in total dividends from AMT. Including these payouts, our total return is an awesome 57% in less than two years since we bought AMT in November 2018.

Thanks to its excellent economics and ever-rising dividend, the stock remains a great play today. AMT just inked a new 15-year deal with T-Mobile, giving the cell phone carrier access to AMT’s towers.

T-Mobile likes the deal because it will help accelerate its 5G rollout, while we like the agreement because it gives us more dividends down the road.

Action to Take: Buy American Tower up to $280.00 per share.