Gold bullion is now down about 10 percent from its high of $2,075, putting it in correction territory, observes Frank Holmes, CEO of US Global Investor and editor of Frank Talk.

I’ve already seen numerous headlines questioning whether this is the end of the gold rally. Hardly. Corrections such as this are normal and healthy. They’re a part of gold’s DNA of volatility.

During the monster rally of the 2000s that culminated in gold hitting its previous record high of $1,900, there were several significant pullbacks, some of them exceeding 20 percent.

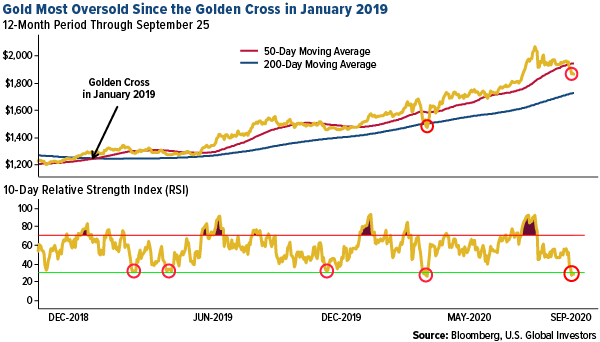

Take a look below. Gold is now more oversold on the short-term, 10-day relative strength index (RSI) than at any other time since the golden cross took place in January 2019. The last time the precious metal was this oversold, in mid-March, gold fell below not just its 50-day moving average but also its 200-day average.

We’re not quite there yet — gold is trading below its 50-day but still well above the 200-day—but had you bought the March dip, you would have seen your position increase 40 percent over the next five months.

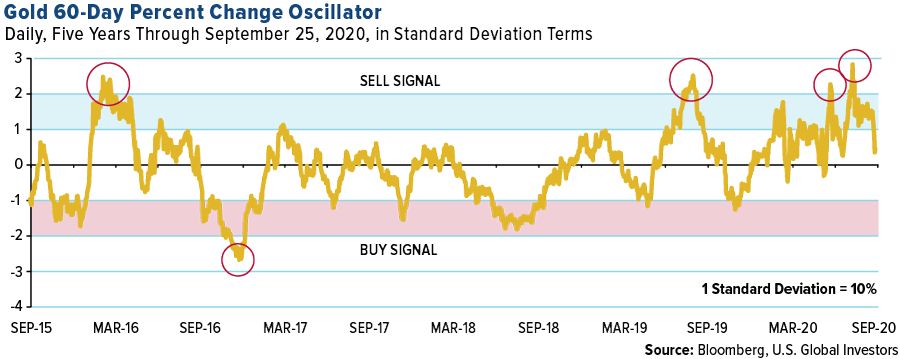

Looking at a longer-term period, gold doesn’t yet appear to be oversold. The oscillator chart below is based on the daily gold price over a rolling 60-day period, which is equivalent to a three-month quarter. As you can see, gold has recently fallen out of overbought territory and is returning to its five-year mean, or average price.

It’s important to remember that for the 60-day period, a move of one standard deviation is equivalent to 10 percent. In other words, the price of gold needs to changer by 10 percent to record a move of one standard deviation.

With real rates still negative (and likely to remain that way for some time longer), and unprecedented money-printing threatening to heat up inflation, I believe it only makes sense to buy the dips at this time.

Gold and silver are in “golden times” right now, according to Randy Smallwood during an online Denver Gold event. The “helicopter money” from governments will continue to be highly supported of prices. Smallwood is the president and CEO of royalty streamer Wheaton Precious Metals (WPM).

Randy is also optimistic of base metals, saying they were likely to be the bulk of streaming deal opportunities. “It’s good to see money going to the ground in the base-metals space,” he commented.

Wheaton Precious is planning to list on the London Stock Exchange, which will put the $23 billion streaming company on the radar of United Kingdom investors who are seeking to gain equity exposure to precious metals. Wheaton currently trades in Toronto and New York.

I believe this is a well-timed decision on the part of Randy, who was named the new chair of the World Gold Council (WGC) earlier this month.

According to Edison Investment Research, precious metal companies listed in London “have tended to outperform their peers, with 52 percent of London-listed companies outperforming the gold price over the period of the worst depredations of the coronavirus so far this year, compared with 39 percent globally.”

As you know, Wheaton is one of our favorite mining stocks. At present it pays out 30 percent of its cash flow in dividends, but this could rise to between 40 percent and 50 percent with higher metal prices, Randy says.

Another royalty and streaming company we have our eye on is Maverix Metals (MMX), formed in 2016 after the company acquired a package of assets from Pan American Silver (PAAS).

Maverix has just entered into a binding purchase and sale agreement to buy a portfolio of 11 royalties from Newmont, including the Camino Rojo gold and silver project in Mexico.

The transaction, according to a note by Raymond James, “provides Maverix with potential near-term gold equivalent ounce (GEO) and cash flow growth from five development assets in the Americas, while adding longer-term optionality through the six exploration properties.”

Raymond James has given the stock an Outperform rating, with a price target of C$7.50. We like the stock and, based on our quant stock-picking model, added it our portfolio.