Income investors looking for defensive exposure to high-yielding securities are well served by investigating the preferred shares sector; preferreds provide a good hedge against market volatility as their share price tends to fluctuate much less than common stocks, asserts Rida Morwa, editor of High Dividend Opportunities.

For income investors, the markets offer several closed-end funds (CEFs) that invest in preferred stocks. Investing in CEFs has many advantages. They provide active management and instant diversification.

In many cases, they also offer leverage, which can boost both income and capital gains. Because they are large funds, CEFs can get very competitive leverage rates that would be very difficult for individual investors to obtain.

Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP) is run by a fund manager that's the best in their field. Unlike an ETF, where you are buying an index and the sponsor isn't all that important, with a CEF the performance of the manager is critical.

DFP is a higher quality fund. The reason is that DFP must have 80% of its assets in either investment-grade preferred stocks, or if the securities are not investment grade, the issuing company must have investment-grade debt.

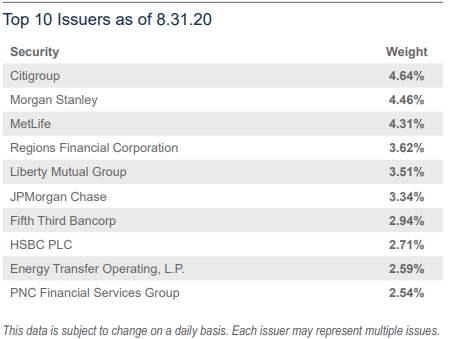

By allocating some of their funds to the border of the investment-grade transition, DFP gets better yield without a lot of extra risk. Most preferred securities are issued by banks and insurance companies, so it comes as no surprise that the lion's share of DFP's holdings come from these two sectors.

While the majority of the assets are from the US, there's some international exposure as well, mostly in Europe. Having some international exposure helps lower the foreign exchange risk and hedges against further devaluation of the US dollar.

The dividend is paid on a monthly basis. It carries a nice yield of 7.4% which is generous relative to the safety and the quality of the fund.

While many dividend stocks have reduced their payout since the pandemic, DFP has done the opposite. The fund was able to hike its dividend twice, once in June and once in August of this year.

The total hikes were significant and amounted to a 15.4% increase in the payout since the beginning of this year. This is thanks to the management of Flaherty & Crumrine which have proved once again that they can weather any storm and come out on top.

Remember, the markets are volatile, and if you are an income investor concerned about protecting your capital, preferred stocks are one of the best ways to invest. DFP makes a great addition for conservative income investors, and those in retirement. The yield is generous, and the opportunity is unlikely to last long.