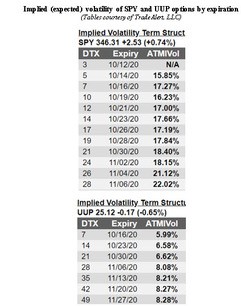

With only weeks until the election, anticipated volatility is loud and clear in terms of how options are priced, observes Todd Salamone, technical expert and senior vice president of research at Schaeffer's Investment Research.

For example, note how expensive options are on the SPDR S&P 500 ETF Trust (SPY) and the Invesco DB U.S. Dollar Index Bullish Fund (UUP) for those options expiring before and after the election.

But I do not see market participants positioned for such volatility, at least not as the media has suggested. For example, total put open interest on SPY options, which fund managers can purchase to hedge equity exposure in anticipation of increased volatility, is around 13.7 million contracts, down from the 15.4 million contracts one month prior to the November 2016 elections.

In fact, total put open interest at present on the SPY is down from the 17.5 million contracts in April, implying there was more of a desire to hedge emerging COVID-19 risk than election uncertainty.

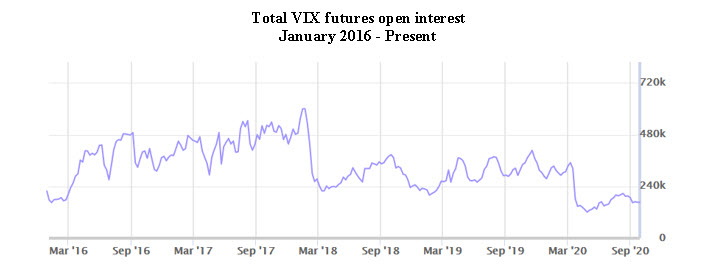

Moreover, total open interest among Large Speculators on CBOE Market Volatility futures is nowhere near the level that preceded the November 2016 election.

Prior to that election four years ago, total open interest on VIX futures among Large Speculators exceeded 360,00 contracts, or 200,000 more contracts than at present, according to the most recent Commitment of Trader’s (CoT) report.

And VIX call open interest is currently just 4.7 million contracts, which pales to this year’s peak of 8.5 million contracts in March.

Open interest on currency futures, such as the safe-haven yen and the risk-associated dollar, is also significantly below the levels reached in the spring, when COVID-19 uncertainty was raging.

That being said, large speculators are net short the dollar and long the yen, indicating that those that are participating in these markets are using these currencies to hedge a negative outcome for risk-based assets.

Might this low SPY put open interest be indicative of a fund manager crowd that is managing perceived election volatility by reducing equity exposure? This is quite possible, as lower equity exposure than normal would require less actions to hedge equities.

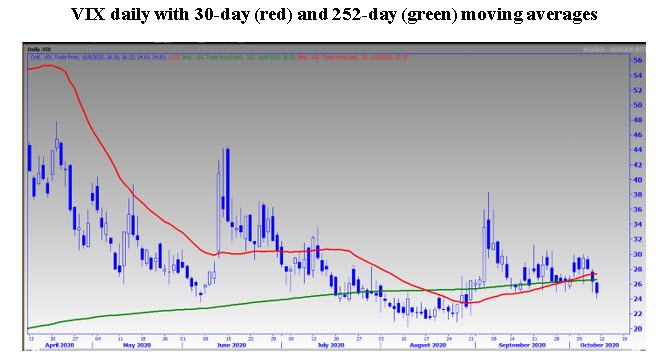

Even as potential election volatility continues to be a popular media theme, perhaps scaring many out of equities, there has been an interesting development is the Cboe Volatility Index’s second consecutive close below its 252-day moving average last Friday.

This occurred after it traded above this important moving average for all but one day since August 31st. The VIX also closed below its 30-day moving average, which I have been following closely.

The bullish VIX signal was concurrent with the S&P 500 Index (SPX) close back above 3,400 and its February high, the Russell 2000 Index (RUT) close above 1,600 — which acted as resistance in August and September — and the turn lower in the equity-only, buy (to open) put/call volume ratio, which is also bullish.

Even as parts of Europe approach lockdowns again, could positive developments last week in the treatment of COVID-19 trump election uncertainty?

If so, a contrarian play to the media’s higher election volatility theme would be to position for lower volatility and higher stock prices in the days before and after the election. If the VIX moves back above its 30-day and 252-day moving averages, all bets are off.