AT&T (T) is the biggest telecom company in the world. It rakes in around $170 billion in annual revenue, asserts fundamental and technical expert Rich Suttmeier, editor of 2-Second Trader.

The company offers broadband, mobile, and landline services. It's also the parent of Warner Media, making it a leader in the entertainment industry. The conglomerate is headquartered in Dallas, Texas.

Shares of AT&T have slumped lately, despite the broad strength in the stock market — but this underperformance creates a great buying opportunity for us. By buying shares of AT&T today, we could generate a gain of more than 50% over the next few months. We'll also benefit from the dividend yield, which currently sits above 7%.

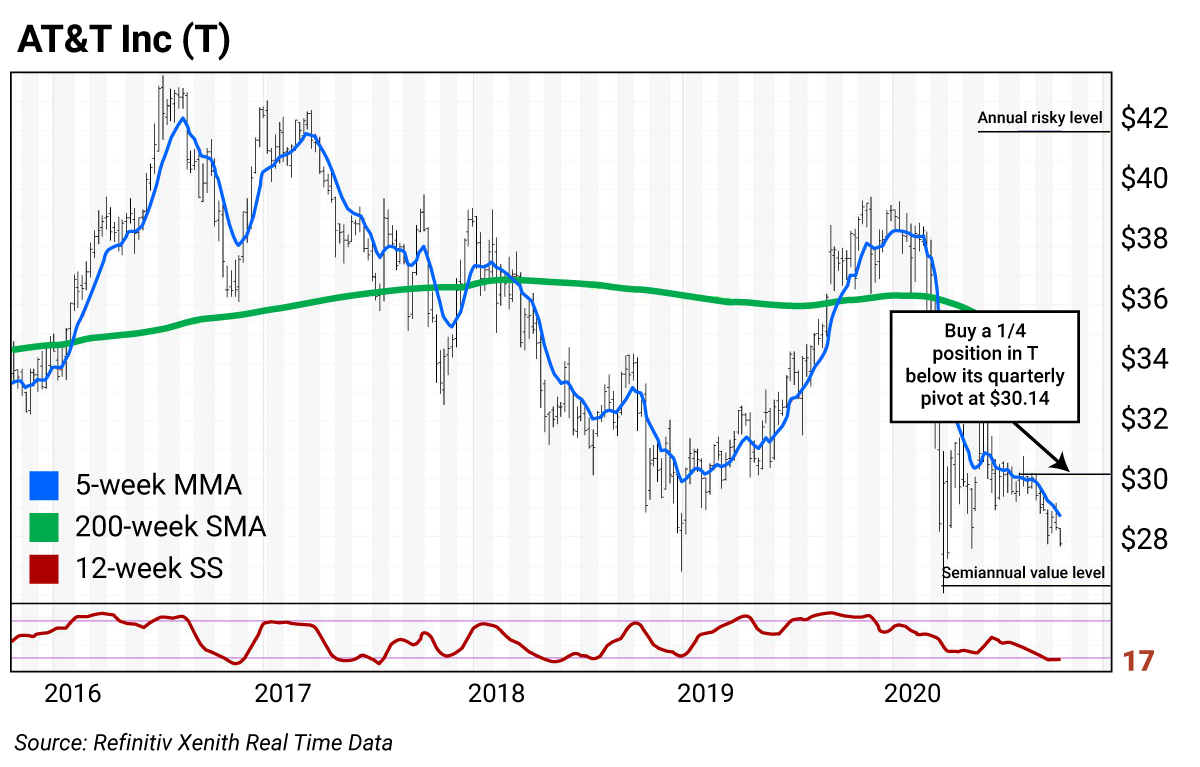

As you can see from the chart above, AT&T has been trading lower since July 2016, when it traded as high as $43.89. Over the past few years, the stock repeatedly broke through its 200-week simple moving average (SMA). That's the green line that runs across the middle of the chart.

AT&T broke above the green line back in 2016. It broke below the line two years later, in early 2018. It rallied back above the line in late 2019, but broke down again this year during market-wide weakness caused by the coronavirus pandemic. Today, AT&T sits well below the 200-week SMA at $34.61. This makes it a great candidate for a "reversion to the mean" trade.

The first thing you should check out is AT&T's 12-week slow stochastic (SS) reading, which ranges 0–100 (read line at the bottom of the chart). When the 12-week SS reading falls below 20, it means the stock is oversold. As you can see, AT&T's reading has fallen to 17, which means now is a good time to buy.

Another important signal comes from our Black Box tool. AT&T recently fell below its quarterly pivot of $30.14. As a result, the stock is sitting in a "buy" zone. This is the range between its semiannual value level of $26.31 and its quarterly pivot of $30.14. As long as the stock sits in this range, it's a great buying opportunity.

Holding this range will likely lead to an upside rally to the annual risky level. For AT&T, this means that shares could eventually rally up to $41.98 (its annual risky level). If I'm right, our potential gain is more than 50% from where the stock is currently trading.

We'll also collect a generous dividend yield of over 7% while we wait for the stock to gain upward momentum. Remember, we want to buy AT&T while it's below its quarterly pivot. That means we don't want to pay a penny above $30.14.