Shiller’s Cyclically Adjusted P/E (“CAPE”) valuation measure was recently at its second highest valuation ever, cautions Alan Newman, market timing specialist and editor of CrossCurrents.

This reading was second only to the massive stock market mania that ended in 1929 with the worst crash in history, followed by years of pain. It’s worth repeating that the 1929 high was not exceeded until 1956, 27 years later. Could it happen again? Absolutely!

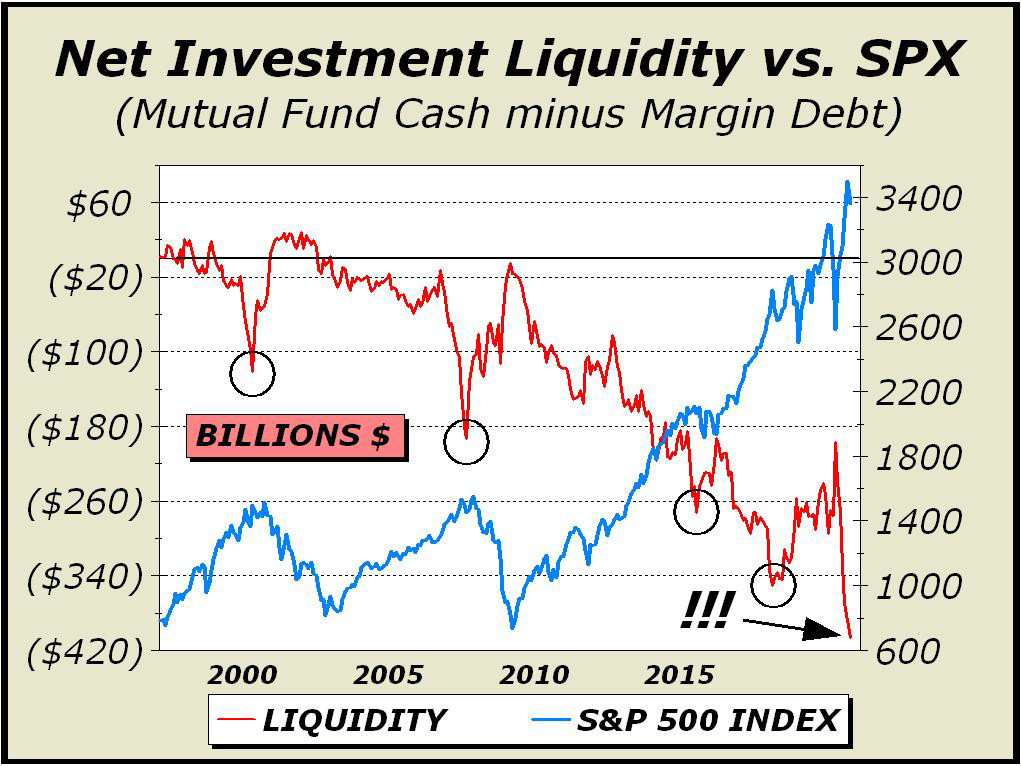

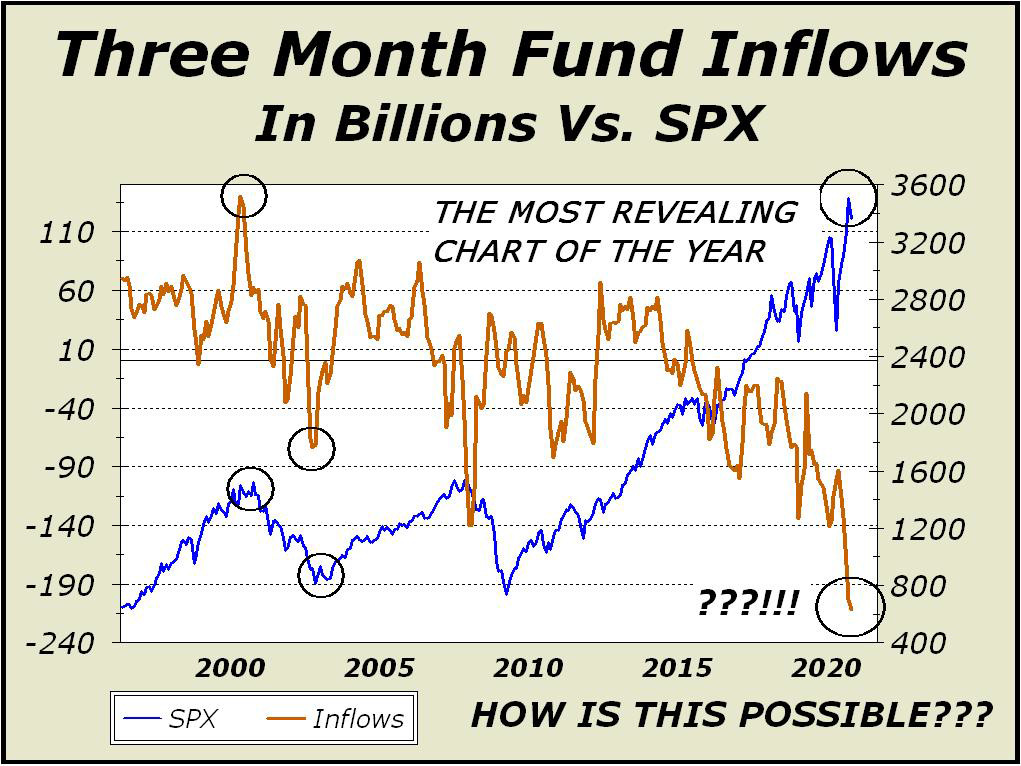

If we were confined to present just one chart, the picture just below would be the only chart that could possibly qualify. This perspective sums up the last few years perfectly.

The three month inflows have cratered to levels we’ve never seen before and we’ve been a market observer for 56 years. Despite the massive outflows, the S&P 500 was enabled to continue a decade long rise to the stratosphere.

Of course, this final leg was propelled by the FAANGM stocks. This group has been responsible for much of the fun, which we now believe will be countered by pain, lots of pain. The group now trades near a 50 P/E and all are above 30 times earnings.

This is not a group of small high tech flyers that might temporarily deserve such high multiples. The group is now valued at nearly $7 trillion, roughly 30% of the entire S&P 500.

The chart below shows that there is still no climax in market trading. In my view, the bear market cannot end until there are a series of climaxes, marked by trading sessions when the Nasdaq's down volume swamps up volume by 9 to 1.

So far, the only session that has qualified as a climax occurred on March 12th when up volume of 475 million shares was swamped by 4.532 billion shares of down volume. This single example of capitulation has yet to be duplicated.

Overall, we see extreme complacency and excessive risk. We listed “Katy Bar The Door” support at 24,843 and we’re keeping that number as of now. A break below should trigger a cascade down. The next key number to watch would be the round number of Dow 23,000. We would expect a break below 23k to result in a full fledged test of the March 23rd low of 18,213.