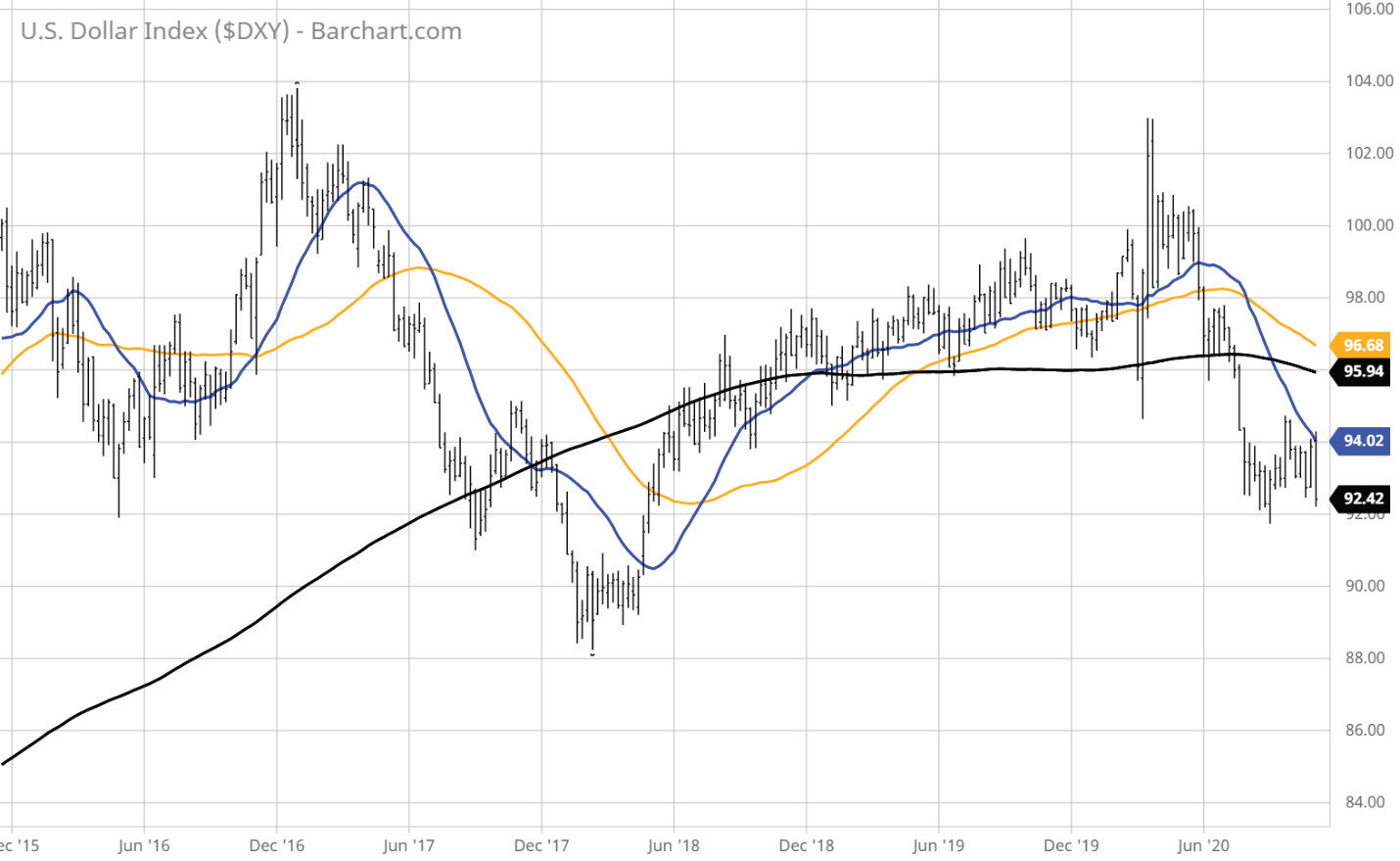

A notable development that needs to be closely monitored is the fresh weakness in the U.S. dollar against other currencies. The U.S. Dollar Currency Index (DXY) is testing key support at 92.0, where if taken out, opens the way to 88.0, suggests Bryan Perry, editor of Cash Machine.

A breach of 88.0 would invite a steep sell-off to the 80.0 level and, in my view, be largely disruptive to the bond and equity markets.

Bond yields will likely rise as buyers of Treasuries would demand higher yields to compensate for a weaker currency, and equities would slide in reaction to the notion of a slide in the creditworthiness of the dollar as the world’s reserve currency in conjunction with a spike in Treasury yields.

The primary beneficiary sectors from a dollar correction would be gold, silver, the precious metals mining sector and floating rate assets. We’re already seeing some of this correlating price action this week, as gold, silver and mining stocks rallied strongly.

I believe the Fed has, within its powers, to buy dollars to support the currency if it is in its best strategic interest, but its ability to stabilize a falling dollar is limited.

The foreign exchange, or forex, market is the largest financial market in the world — larger even than the stock market, with a daily volume of $6.6 trillion, according to the 2019 Triennial Central Bank Survey of FX and OTC derivatives markets.

The dollar is losing ground under the perception that another massive stimulus bill is coming down the pike by the year’s end and another wave of the coronavirus will impact the current fourth quarter and first-quarter 2021 growth prospects.

While it is too early to call whether the scenario will play out, the trend is moving in the wrong direction. Just something to keep an eye on in the event it starts to matter to Mr. Market.