During his campaign, Joe Biden proposed the decriminalization of cannabis on a federal level. Also, in several state elections, voters overwhelmingly moved toward legalizing cannabis, explains Mark Skousen, growth stock expert and editor of Fast Money Alert.

This is a welcome trend in our opinion, not because we advocate the use of drugs (we do not), but because we advocate freedom — the freedom for a citizen to make his/her own choices as long as those choices do not impinge upon another citizen’s freedom.

This is what liberty means, in the real world, and we are champions of liberty. We also are champions of making money with the right stocks and options in this service and making it fast by taking advantage of where the fast money is headed.

Cannabis stocks could be at the beginning of a big move higher. Our favorite cannabis play here at this juncture is Canopy Growth Corporation (CGC).

The Canadian company has support from and is partially owned by beverage giant Constellation Brands (STZ). In fact, Constellation upped its stake in CGC in May 2020 after its initial investment in 2017, but that’s just one thing to like about it.

Another thing to like is Canopy Growth's recent earnings report, where the company posted a smaller quarterly loss, lower production costs and more demand from what it said was people turning to cannabis to cope with the coronavirus lockdowns.

More importantly, Canopy’s CEO David Klein said that he expects the company, which is the world’s largest pot producer, to become profitable in fiscal 2022.

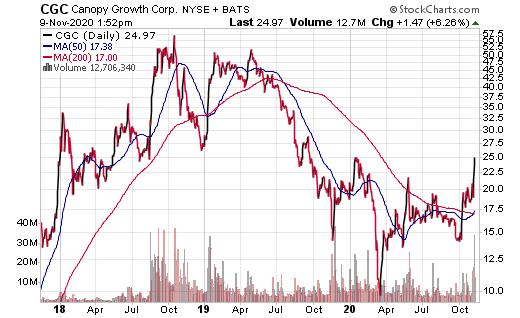

Wall Street likes this message, as CGC just recently hit a new 52-week high. Yet the shares are far from their recent highs. The three-year chart here shows that CGC has plenty of room to move up to its multi-year high in late 2018.

Given the political tailwinds at its back, and the strong market leadership in Canopy Growth, now is the time to get back on the cannabis trail with a stock that represents a victory for liberty.