We feel the current rally in the US stock market is an “excess phase” (blow off top) rally that may extend well into early 2021 before suddenly shaking out the hype, notes Chris Vermeulen, chief market strategist at The Technical Traders.

The US Fed, and global central banks, are fueling the rally with easy monetary policies — attempting to keep the party going.

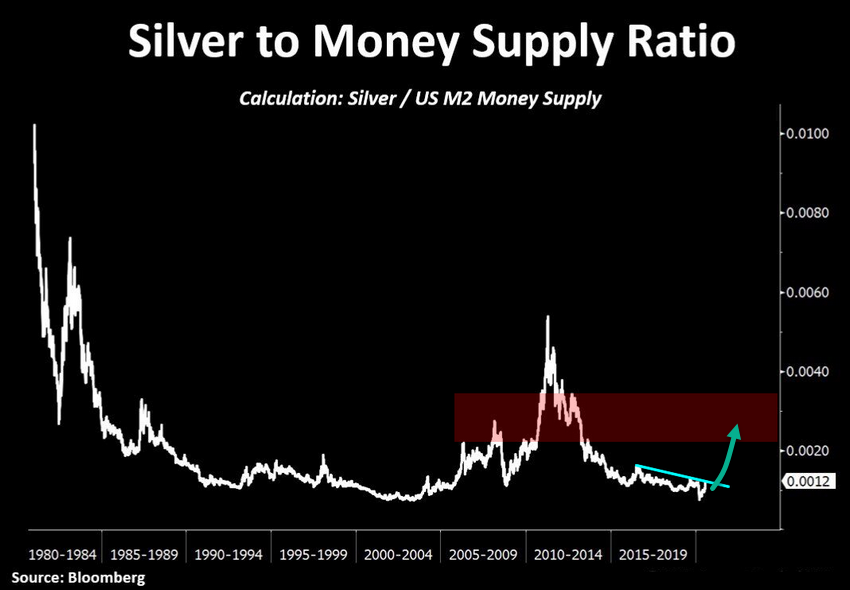

Meanwhile, these long-term Bloomberg Commodities Index and Silver to M2Money Supply charts highlight the extended downtrend in commodities over the past 12 years.

Our analysis suggests the global markets are shifting away from a stock market appreciation phase into a depreciation phase. This shift will likely prompt a new commodities sector appreciation phase to begin fairly quickly.

The deep lows of the COVID-19 market collapse may have setup a major bottom in the Commodities Index going forward. If our research is correct, commodities should start a major upward price trend which lasts for 5 to 7 more years.

We have highlighted a mean price range (in RED) from the 2009 to 2013 area suggesting commodity prices could recover to this level fairly quickly in a new Appreciation phase.

The following Silver to Money Supply Ratio chart highlights how inexpensive Silver is in comparison to historical values. Even though Silver is trading near $26 per ounce right now, historical mean levels in Appreciation phases suggest Silver could rally 200% to 300% (or more) from these lows.

We’ve highlighted an area in RED on this chart showing a moderate mean average of the last Appreciation phase (2004 through 2011).

My research team and I believe a 9 to 9.5 year appreciation/depreciation cycle takes place in stocks and commodities, and the relationship between the two is inverted.

When and IF this excess phase US and Global stock markets ends, commodities and precious metals should really begin to skyrocket higher. Junior miners, seen in this chart below, should begin to move higher in advancing legs.

We’ve drawn these legs on the chart (below) as arrows — showing you how price may advance in the future. Each advancing leg will “reset” after a brief pause/pullback, then another advancing leg will begin.

Remember, this is a longer-term appreciation phase in commodities and metals that should last through 2026~2027 (or longer).

Junior Silver Miners (SILJ) should begin to advance to levels near $21, then stall for a few days/weeks, then attempt to advance to levels above $28~$30 if our research is correct. This advance in the Junior Silver miners will not likely peak near $30 though.

This rally in metals, miners, and other commodities may last well beyond 2026~27 based on our research. This type of trend could really turn into a life-changing appreciation/depreciation phase for traders.